Fashion DTC Logistics Visibility: How to Manage Peak Season Without Chaos

Fashion DTC Logistics Visibility is what keeps your brand calm when orders surge, carriers slow down, and customers start checking tracking every few hours. Peak season pressure is predictable. The chaos is optional. You reduce it when you connect inventory, fulfillment, and carrier signals into one operational view and act on exceptions fast.

1. What “peak chaos” looks like for fashion DTC

1.1 Volume spikes plus SKU complexity

Fashion orders are rarely simple. Peak baskets often include multiple sizes, colors, and bundles. That increases:

- split shipments from different nodes

- partial allocations when stock runs thin

- picking errors and substitutions

These issues escalate quickly if your team cannot see the real status across systems.

1.2 Promise risk becomes brand risk

A late hoodie hurts, but a late party dress hurts more. During peak, customers buy for dates, travel, gifting, and seasonal timing. When the delivery promise fails, refunds and chargebacks rise, and social posts spread faster than your support queue can respond.

1.3 Returns spike right after peak

Fashion returns surge after major holidays. If you do not track returns with the same discipline as outbound shipping, you lose inventory accuracy and margin. Visibility must cover reverse flow, not only delivery.

2. The real goal of Fashion DTC Logistics Visibility

Many brands think visibility means “we have tracking numbers.” That is not the goal. Fashion DTC Logistics Visibility should answer operational questions in seconds:

- Which orders will miss the promised window in the next 48–72 hours?

- Which warehouse is building backlog today?

- Which lanes are degrading right now, and what should we reroute?

- Which exceptions need a customer message today?

If your system cannot support those questions, it will not protect you in peak season.

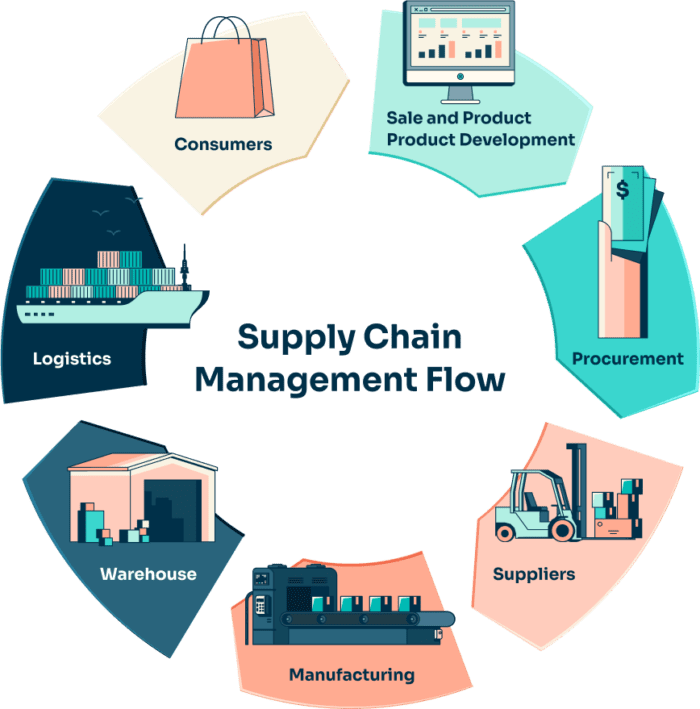

3. Build visibility in 3 layers (so teams stop guessing)

3.1 Order layer: one timeline for one customer experience

Create a unified timeline that merges commerce + ops:

- order placed and paid

- inventory allocated (or backordered)

- pick/pack complete

- carrier handoff confirmed

- in-transit milestones

- delivered (or failed delivery)

- return initiated and received (if any)

This is the customer reality. It should not live across five tools.

3.2 Fulfillment layer: where peak problems start

Peak delays often begin before the first carrier scan. Track:

- order-to-pick time

- pick-to-pack time

- pack-to-handoff time

- cut-off misses by carrier

- “packed but not collected” volume

When these metrics drift, shipping delays follow. Visibility without fulfillment signals is incomplete.

3.3 Carrier layer: normalize milestones and exceptions

Carriers describe the same event in different ways. Map raw statuses into a consistent taxonomy such as:

- Label Created

- Picked Up

- Departed Origin Facility

- Arrived Sort Center

- Customs Hold / Cleared

- Out for Delivery

- Delivered

- Exception (with reason)

That mapping improves dashboards, alerts, and customer updates. It is also a core part of Fashion DTC Logistics Visibility.

4. The 5 peak-season controls that prevent chaos

4.1 Identity mapping for split shipments

Peak season creates more split orders. Your system must link:

- one order ID → multiple shipments → multiple packages → multiple tracking IDs

If you do not normalize that relationship, you will show “delivered” while half the items are still moving. That triggers unnecessary refunds.

4.2 A “promise engine” driven by lane performance

Do not rely on carrier SLAs alone. Use recent performance by lane and service:

- median transit time

- 90th percentile transit time

- first-scan latency

- facility dwell time

Then set checkout promises that match reality. This is where Fashion DTC Logistics Visibility protects conversion and reduces post-purchase friction.

4.3 Exception playbooks with ownership

Every exception should have:

- a reason code (best available)

- an owner (warehouse, carrier, customer, customs)

- a standard next step

- a customer message template

When ownership is unclear, teams debate while the clock runs.

4.4 Proactive customer messaging (short, early, specific)

Peak support collapses when updates arrive late. Trigger messages when:

- no scan appears after pickup within a threshold

- delivery date shifts beyond the promise window

- address issues block delivery attempts

Keep messages direct. Avoid vague wording. Customers handle delays better when they understand the cause and the next action.

4.5 Returns visibility that feeds inventory truth

Treat returns like shipments with milestones:

- return created

- first carrier scan

- in transit

- received at facility

- inspected and restocked

- refund issued

This closes the loop and keeps availability accurate for ongoing peak campaigns.

5. The 3 dashboards your team actually needs

5.1 At-risk orders (the “save list”)

This is the heartbeat of Fashion DTC Logistics Visibility in peak. Include:

- orders forecasted to miss promise date

- shipments with no scan after handoff

- packages stuck at a hub beyond baseline dwell

- repeated delivery attempts or address issues

Filters should include lane, carrier, warehouse, and order value tier.

5.2 Backlog and cut-off health

Track operational flow:

- open orders by aging bucket (0–4h, 4–12h, 12–24h, 24h+)

- pick/pack throughput by shift

- carrier pickup completion rate

- missed cut-offs and the affected order count

If you see backlog rising, you can throttle promos or shift labor before the delay becomes public.

5.3 Network performance by lane

Show daily trends:

- on-time delivery rate by lane

- exception rate by lane

- first-scan latency by carrier/service

- top 10 congested hubs by dwell time

This dashboard supports rerouting decisions fast.

6. Two peak-season playbooks that pay off immediately

6.1 “No scan after pickup” playbook

Trigger: pickup confirmed, but no carrier scan after X hours.

Actions:

- verify pickup manifest vs scanned count

- open a carrier trace automatically

- flag high-value orders for escalation

- message customers early with a realistic ETA window

This single playbook reduces “Where is my order?” tickets quickly.

6.2 “Stuck at hub” playbook

Trigger: dwell exceeds 2× lane baseline.

Actions:

- update ETA logic for the impacted lane

- reroute new volume away from that hub/service if possible

- prioritize time-sensitive orders for escalation

- adjust checkout promises for the next 24–72 hours

This is operational control, not reporting.

7. A fast rollout plan (3 weeks, peak-ready)

Week 1: unify milestones and order timelines

- normalize order → shipment → package links

- standardize event taxonomy across carriers

- launch the at-risk orders dashboard

Week 2: automate exceptions and customer updates

- deploy no-scan and dwell alerts

- add reason codes and ownership routing

- turn on proactive messages for top exceptions

Week 3: improve promises and reroute volume

- adjust promises by lane performance

- shift volume across services or partners when lanes degrade

- tighten cut-off discipline and pickup reliability

Each step strengthens Fashion DTC Logistics Visibility without a full rebuild.

8. What “calm peak season” looks like

When Fashion DTC Logistics Visibility works, your team stops chasing screenshots and carrier portals. You spot risk early, act with playbooks, and communicate clearly. Orders still face delays sometimes, but the business stays controlled: fewer refunds, fewer tickets, better promise accuracy, and stronger repeat purchase after the season ends.

Conclusion

Peak season pressure is normal, but chaos is not. Fashion DTC Logistics Visibility helps you spot risk early, act on exceptions fast, and keep promises realistic. That reduces support tickets, refunds, and last-minute firefighting while protecting customer trust.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua