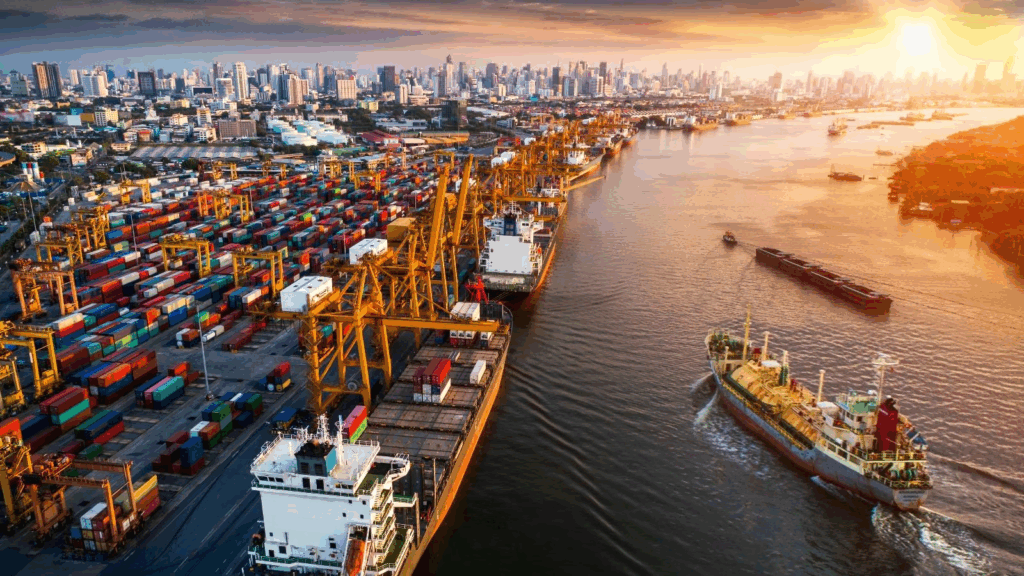

Cross-Border Ecommerce Logistics Opportunities in Southeast Asia

Cross-Border Ecommerce in Southeast Asia is booming. Smartphones are affordable, social commerce is thriving, and buyers are young and digitally active. Yet cross-border logistics still determines who scales and who stalls. With the right playbook—and a platform like PostalParcel for fulfillment and tracking—sellers can tap into new markets, keep costs low, and reduce risks. This guide highlights the biggest Cross-Border Ecommerce opportunities in the region and shows how to act on them with simple, practical steps.

1. Cross-Border Ecommerce Market Order in Southeast Asia Logistics

Not every market has the same friction. Start where you can learn fast.

- Singapore, Malaysia: predictable customs and strong payments. Good for premium goods and trials.

- Thailand, Vietnam: high growth and improving clearance. Local chat support and language matter.

- Indonesia, Philippines: huge demand, but islands and COD raise complexity. Plan for more delivery attempts and multi-carrier setups.

Launch cross-border first. When an SKU gains traction, place stock in the region to offer 1–3 day delivery.

2. Use Marketplace Rails Without Getting Locked In

Shopee, Lazada, and TikTok Shop lower entry barriers. They also offer linehaul and pre-clearance. Use them, but keep control.

- Pipe marketplace and DTC orders into one postalparcel queue.

- Compare marketplace lanes with independent carriers.

- Route by promise date, cost, and risk, not by habit.

Flexibility keeps you safe when fees, rules, or algorithms change.

3. Customs Compliance for Smooth Southeast Asia Logistics

Customs delays kill margin. Fix them at the SKU level.

- Maintain HS codes, material splits, and origin for every SKU.

- Use realistic values and watch the de-minimis thresholds by country.

- Offer DDP for higher AOV to avoid doorstep surprises.

- Feed clearance outcomes back into the catalog to prevent repeats.

Postalparcel can generate documents, map HS codes, and push data to carriers automatically.

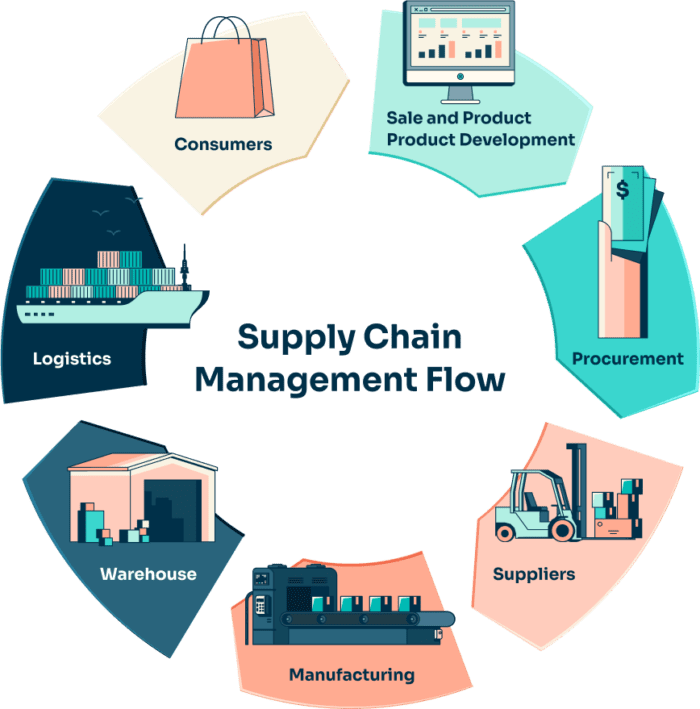

4. Build a Hub-and-Spoke Network

One warehouse rarely fits the region. Mix three layers.

- Origin hub near manufacturing for bulk intake, QC, and export pick/pack.

- Regional buffer hub in Singapore or Malaysia for cross-docking and split shipments.

- Country micro-fulfillment for top movers when volume justifies it.

Use the platform to simulate lead times, costs, and inventory turns before you move stock.

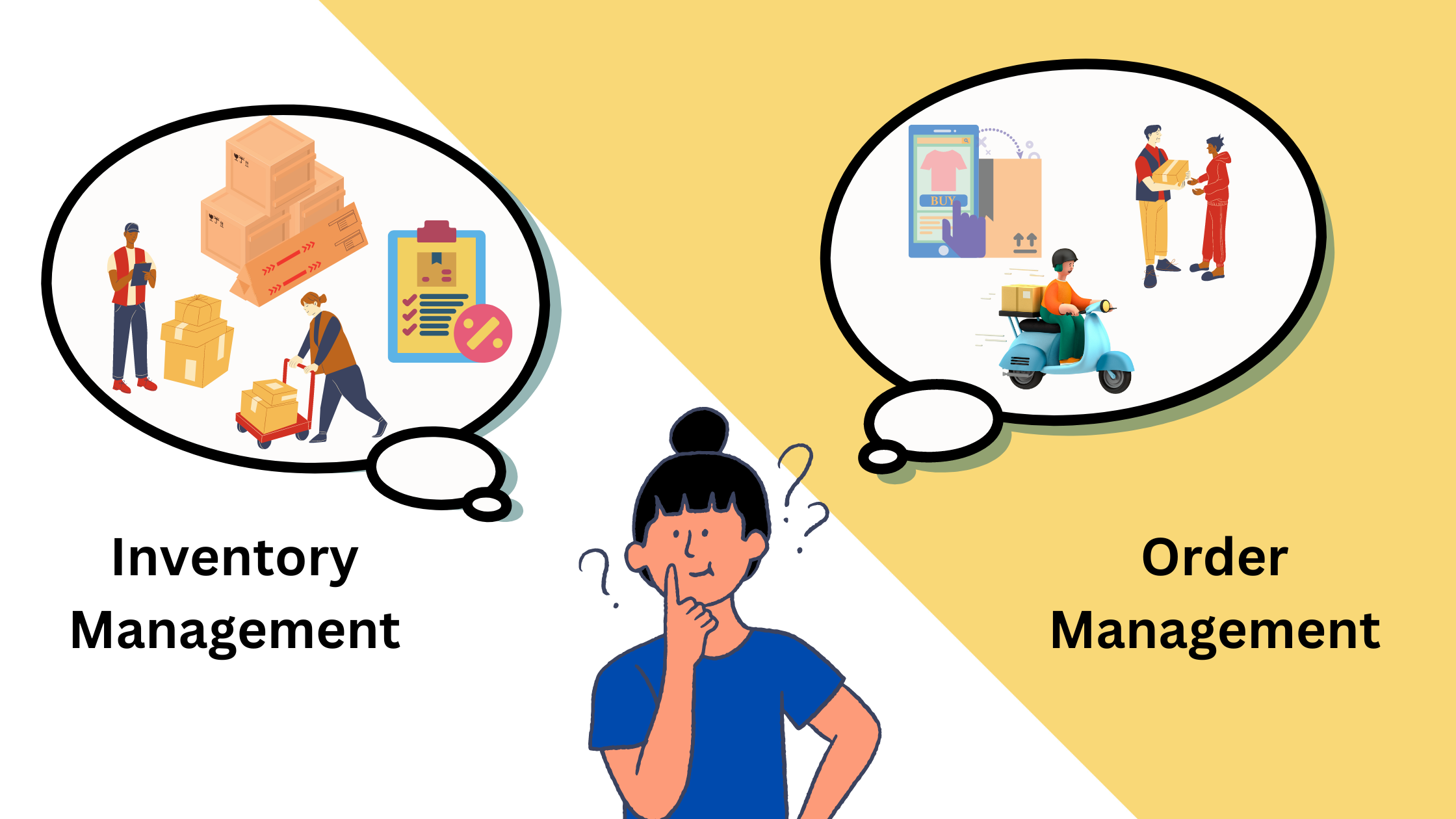

5. Win the Last Mile With Options

Urban routes are dense. Rural and island lanes need backups.

- Offer home delivery, lockers, and pick-up points at checkout.

- For COD markets, verify phone numbers and send day-of-delivery SMS.

- Route with multiple carriers to balance price and first-attempt success.

Postalparcel’s live ETAs, alerts, and self-serve rescheduling cut failed attempts and support.

6. Treat Returns as a Conversion Lever

Shoppers buy more when returns are simple, even across borders.

- Use local return addresses and weekly bulk consolidations back to hubs.

- Grade returns in-region for resale or refurbishment where possible.

- For low-value items, set returnless refund rules to save time and emissions.

Tie each return to the original order in postalparcel and track true landed cost.

7. Manage Payments and Fraud With Logistics in Mind

Payments shape delivery risk.

- Limit COD to first orders or price caps. Reward wallets with small perks.

- Hold high-risk orders for quick checks before pick/pack.

- Sync payment status with fulfillment states so nothing ships too early.

8. Offer Clear Service Levels

Promise dates drive conversion. Over-promising drives churn.

- Show two simple tiers: Standard (green) and Express (time-critical).

- Localize cut-off times and holidays by country.

- Track first-attempt success, on-time rate, and contact-per-order weekly.

Shift volume between lanes before issues grow. Postalparcel scorecards make this easy.

9. Use Data You Can Act On Weekly

Pick a small set of KPIs and review them every Monday.

- Order-to-door lead time by lane

- First-attempt delivery rate and top failure reasons

- Cost per parcel by stage (pick/pack, linehaul, last mile, duties)

- Return rate and disposition by SKU and country

- Tracking page engagement and “Where is my order?” contacts

Set alerts for outliers. Fix root causes, not symptoms.

10. Lower Emissions and Cost Together

Green can be cheaper when done right.

- Consolidate where it does not break the promise.

- Right-size packaging to boost cube utilization.

- Use sea or rail for replenishment; reserve air for exceptions.

- Offer “Eco Delivery” with transparent CO₂ savings on the tracking page.

Postalparcel can estimate emissions by lane, so you can report progress to customers and partners.

11. A 30-Day Starter Plan

- Pick five target lanes and list current carriers and SLAs.

- Clean product data: HS codes, values, materials, and origins.

- Connect DTC store and marketplaces to PostalParcel for unified orders.

- Turn on multi-carrier routing and proactive customer notifications.

- Pilot one local return address; consolidate weekly.

- Review KPIs after 30 days; shift volume to the best lanes.

Small iterations beat big, slow projects.

How postalparcel Helps

- Fulfillment: wave picking, cartonization, hub-to-hub transfers.

- Tracking: live ETAs, status alerts, self-serve delivery changes.

- Routing: carrier selection by promise, cost, risk, and sustainability.

- Customs: auto documents, SKU-level compliance, DDP support.

- Analytics: lane scorecards, exception alerts, and true landed-cost views.

Southeast Asia rewards operators who respect local nuance and use platform discipline. With clear data, flexible routing, and reliable tracking, cross-border logistics becomes a growth engine—not a bottleneck. Plug your channels into postalparcel, start with your best lanes, and scale confidently.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua