Customs and Trade Compliance: Import & Export Documents

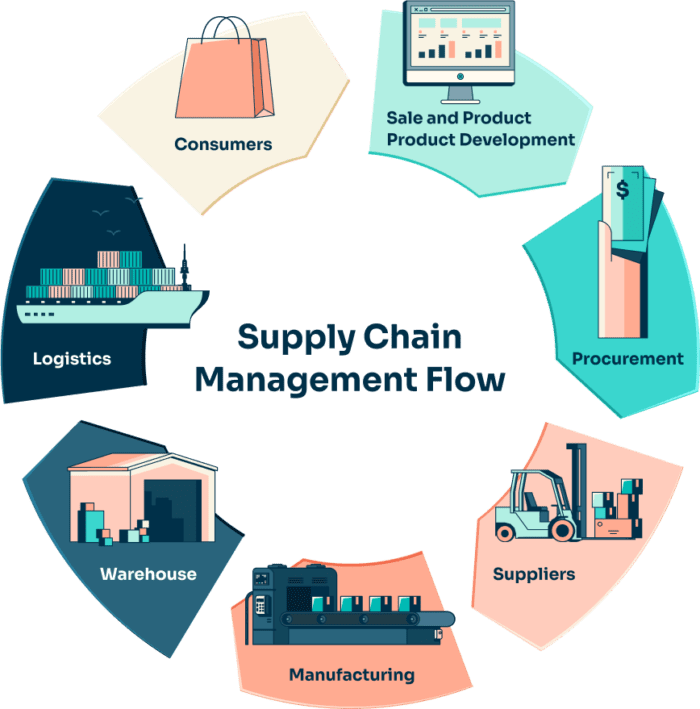

In today’s interconnected global economy, international trade offers immense opportunities—but also brings complexity. One of the most critical components of cross-border transactions is accurate import and export documentation. Whether you’re shipping raw materials or finished goods, proper documentation ensures that your cargo clears customs smoothly and meets regulatory expectations. For businesses aiming to avoid costly delays and penalties, understanding how to prepare these documents with customs and trade compliance in mind is essential.

Why Accurate Documentation Matters

Incomplete or inaccurate trade documents can lead to customs delays, shipment holds, fines, and even reputational damage. On the other hand, well-prepared paperwork demonstrates operational reliability and helps build trust with partners, freight forwarders, and customs authorities. It also plays a vital role in risk management by ensuring that you stay on the right side of trade laws in both the origin and destination countries.

Core Principles of Trade Documentation

Before diving into specific documents, it’s important to recognize the foundational goals of all trade paperwork:

- Transparency: Customs authorities need to understand what you’re shipping, where it’s going, and who’s involved.

- Accuracy: Even minor discrepancies between documents can trigger audits or inspections.

- Consistency: All documents should align on product descriptions, Harmonized System (HS) codes, valuation, and parties involved.

Key Import and Export Documents You Need

Below are the primary documents used in most international trade transactions. Depending on the nature of the goods and the destination country, additional paperwork may be required.

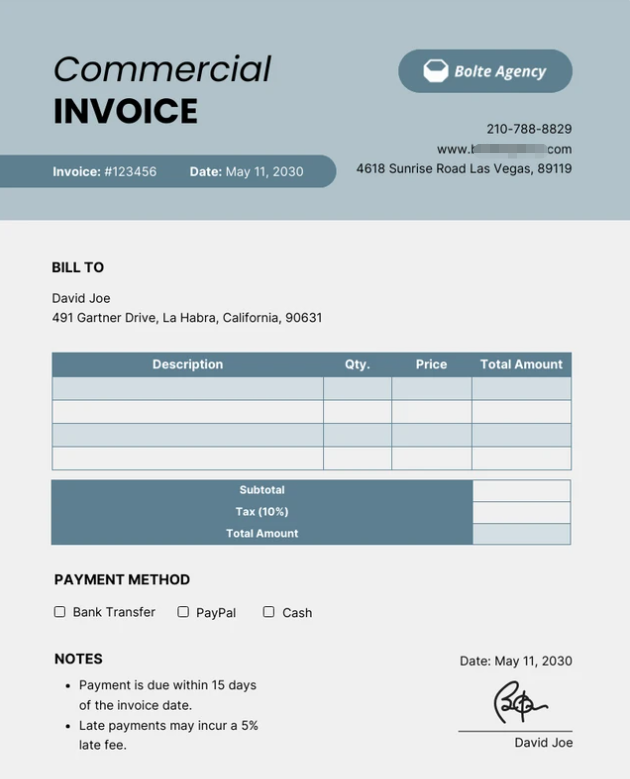

1. Commercial Invoice

The commercial invoice is the cornerstone of your documentation. It includes:

- Seller and buyer contact details

- Invoice number and date

- Description of goods

- Quantity and unit price

- Total value

- Incoterms used (e.g., FOB, CIF)

- Country of origin

For customs and trade compliance, ensure that the HS code and declared value are correct and match other documents.

2. Packing List

While not a financial document, the packing list offers critical logistical information:

- Detailed list of each package, crate, or container

- Dimensions and weight

- Marks and numbers for identification

This helps customs verify cargo and supports warehouse handling on both ends.

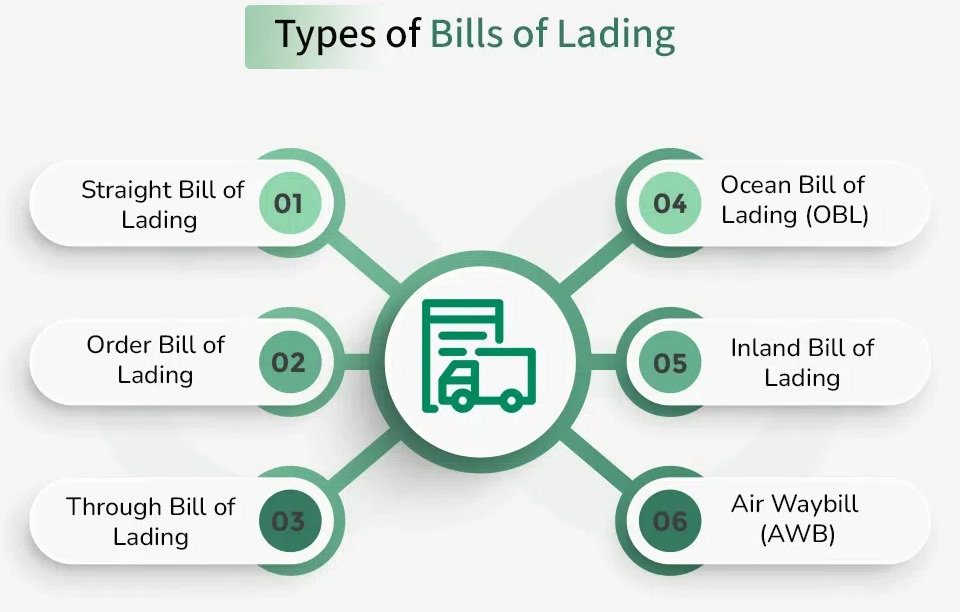

3. Bill of Lading (B/L) or Air Waybill (AWB)

This is the transport document issued by the carrier:

- Confirms receipt of goods

- Acts as a contract of carriage

- Serves as a document of title (especially in sea freight)

Ensure that the consignee and shipment details match those on the invoice and packing list.

4. Certificate of Origin

Issued by a chamber of commerce or trade authority, this document certifies where the goods were produced. Some countries require it for preferential duty rates under free trade agreements. Errors here can lead to higher tariffs or even rejection of goods at the border.

5. Import/Export Licenses (if applicable)

Certain goods—such as chemicals, pharmaceuticals, or military equipment—require special government authorization. Check with trade regulatory bodies to verify whether your cargo needs licenses or permits.

6. Insurance Certificate

This document proves that the shipment is insured against loss or damage during transit. It provides protection for both the buyer and the seller and is often required under Incoterms like CIF.

Best Practices to Ensure Accuracy

Following best practices helps streamline the documentation process and reduces the chance of errors.

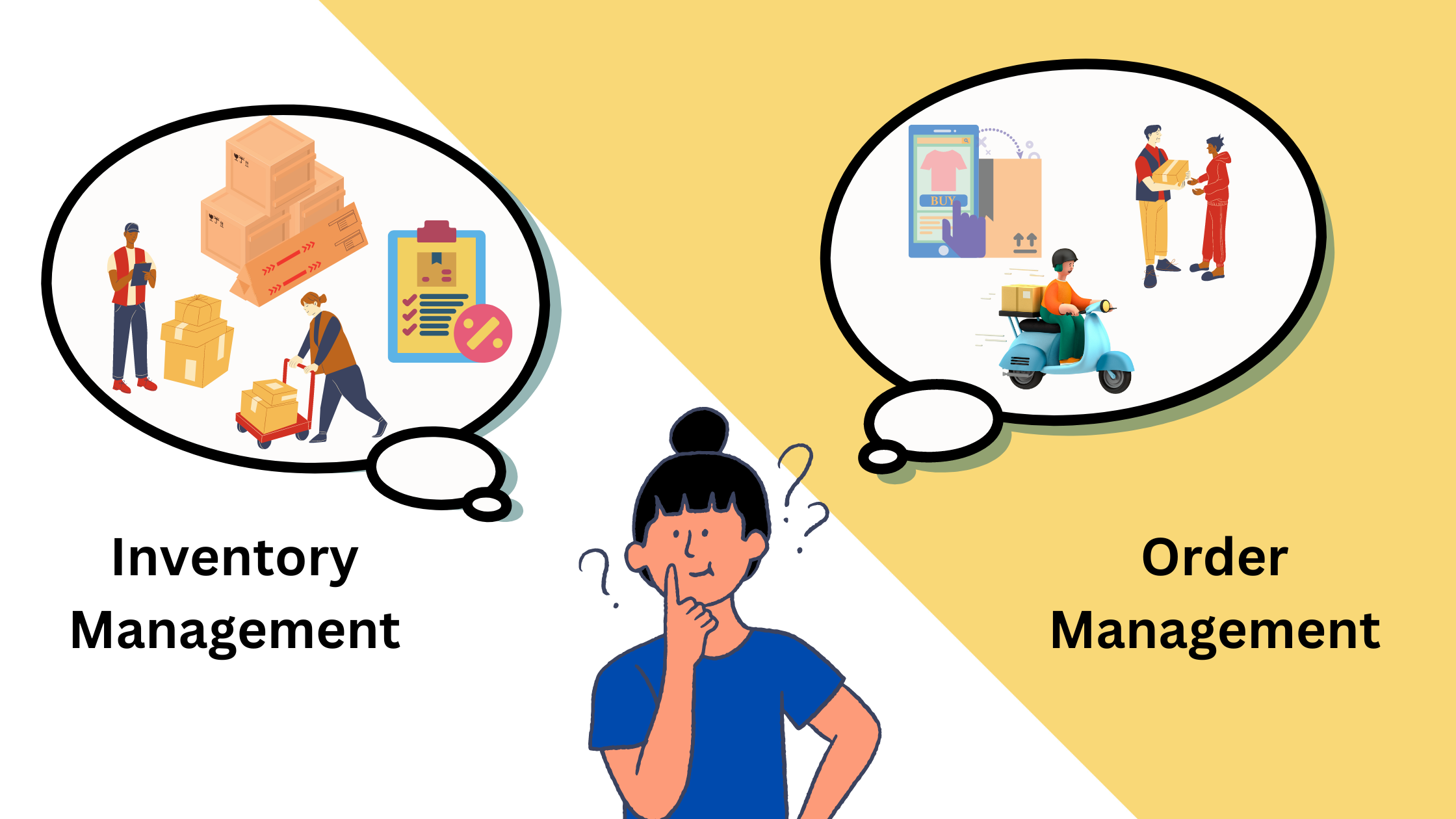

Standardize Internal Processes

Develop templates for invoices, packing lists, and other documents. Use a centralized database for product descriptions, HS codes, and customer information to ensure consistency.

Stay Up to Date with Regulations

Customs and trade compliance rules change frequently. Subscribe to government bulletins, attend industry webinars, or consult trade professionals to remain informed on updates that may affect your shipments.

Leverage Technology

Many exporters use enterprise resource planning (ERP) or trade management software to automate document generation. These tools reduce manual input errors and keep everything aligned.

Double-Check Before Shipment

Set up a document review checklist. Ensure that:

- All information is complete

- Units of measure are consistent

- Dates, values, and codes match across documents

Even small mistakes can lead to big headaches.

Train Your Team

Invest in regular training for logistics, procurement, and sales teams. Everyone involved in the trade process should understand the importance of documentation and how to prepare it correctly.

The Role of Customs Brokers and Freight Forwarders

If your company lacks in-house expertise, it’s wise to collaborate with customs brokers and freight forwarders. These professionals understand the nuances of customs and trade compliance and can assist in preparing, submitting, and correcting documents when needed. However, ultimate responsibility for compliance always lies with the exporter or importer of record.

Final Thoughts

Accurate import and export documentation isn’t just about moving goods—it’s about moving them legally, efficiently, and reliably. With global trade regulations tightening and customs authorities adopting advanced risk assessment systems, the margin for error is shrinking.

By understanding the key documents involved, applying best practices, and focusing on customs and trade compliance at every stage, businesses can reduce delays, avoid penalties, and maintain smooth international operations. It’s not just paperwork—it’s the foundation of trusted trade.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua