Aufstrebende E-Commerce-Märkte, die bis 2025 zu beobachten sind

Die E-Commerce-Märkte wachsen weiterhin stetig, aber die Unsicherheit bleibt, da sich die Verbrauchergewohnheiten ändern. Einzelhändler sehen sich einem globalen E-Commerce-Markt gegenüber, der sowohl eine Herausforderung als auch eine Vielzahl von Möglichkeiten bietet. Laut ShipStation's 2025 Benchmark Report wird der Online-Einzelhandelsumsatz in Nordamerika voraussichtlich um 6.6%und übertrifft damit die Entwicklung in Europa 4.1%dank des gestiegenen Verbrauchervertrauens und der wirtschaftlichen Widerstandsfähigkeit.

Auf dem heutigen Markt werden die Unternehmen, die flexibel und widerstandsfähig bleiben, die Marktführer von morgen sein. Wie können Sie also eines dieser Unternehmen werden? Dieser Artikel befasst sich mit den wichtigsten aufstrebenden Märkten und Strategien, die Ihnen helfen, international zu wachsen.

Die globale E-Commerce-Landschaft im Jahr 2025

Der elektronische Handel wird reifer. In entwickelten Märkten wie Nordamerika und Europa verlangsamt sich das Wachstum. Während 84% der Unternehmen im Jahr 2025 ein Wachstum verzeichneten, betrug der durchschnittliche Anstieg nur 5.6%.

Luxus- und Bekleidungsmarken sind führend bei der globalen Expansion. Sie nutzen digitale Plattformen, um ihre Markenidentität zu wahren und sich gleichzeitig an lokale Geschmäcker und Vorlieben anzupassen.

Internationale Expansion: Warum sie wichtig ist

Die heutige Ausweitung des elektronischen Geschäftsverkehrs wird durch:

- Technologie und mobiler Zugang: In vielen Märkten haben Smartphones und besseres Internet das mobile Einkaufen zur Norm gemacht.

- Digitale Zahlungen: Mobile Geldbörsen und BNPL-Optionen (Buy Now, Pay Later) machen Online-Zahlungen einfacher und sicherer.

- Soziale Plattformen: Apps wie Instagram und TikTok verwandeln sich in digitale Einkaufszentren, die Inhalte und Handel miteinander verbinden.

Zum Beispiel, 74% der Generation Z und 64% der Millennials planen, 2025 auf sozialen Plattformen einzukaufen - aber 46% von Einzelhändlern unterstützen es immer noch nicht. Das ist eine große verpasste Chance.

Die wichtigsten aufstrebenden Märkte für E-Commerce-Wachstum im Jahr 2025

1. Südostasien: Ein Mobile-First-Markt

Zu beobachtende Länder: Indonesien, Vietnam, Thailand, die Philippinen, Malaysia

Warum er wächst:

- Hohe Smartphone-Nutzung und mobile Einkaufsgewohnheiten

- Eine schnell wachsende Mittelschicht mit mehr Kaufkraft

- Staatliche Maßnahmen zur Förderung des digitalen Zahlungsverkehrs und des grenzüberschreitenden elektronischen Handels

Top-Plattformen: Shopee, Lazada, Tokopedia

2. Lateinamerika: Mobile und Fintech treiben das Wachstum an

Zu beobachtende Länder: Brasilien, Mexiko, Kolumbien, Chile, Argentinien

Die wichtigsten Treiber:

- Starke Annahme von Mobiltelefonen

- Zunehmende Nutzung von digitalen Geldbörsen und BNPL-Optionen

- Steigende Nachfrage nach internationalen Marken

Top-Plattformen: Mercado Libre, Americanas, Linio

3. MENA (Naher Osten und Nordafrika): Eine aufstrebende E-Commerce-Region

Zu beobachtende Länder: UAE, Saudi-Arabien, Ägypten, Marokko, Türkei

Wachstumsfaktoren:

- Hoher Internetzugang und Smartphone-Nutzung

- Große Investitionen in digitale Zahlungssysteme

- Steigende Nachfrage nach Luxus- und Weltmarken

Top-Plattformen: Noon, Amazon.AE, Jumia, Trendyol

Schlüsselfaktoren für den Eintritt in aufstrebende Märkte

Es ist wichtig, die lokalen Präferenzen zu kennen. Hier sind einige wichtige Trends:

Beliebte Zahlungsarten

- Digitale Geldbörsen: Am beliebtesten in Südostasien, mit 69% der Zahlungen, die auf diese Weise getätigt werden (FIS 2023).

- BNPL: Immer beliebter, da flexible Zahlungen möglich sind.

- Nachnahme (COD): Immer noch üblich in Gebieten mit geringem digitalen Vertrauen oder geringer Infrastruktur.

Sozialer Handel

- Plattformen wie TikTok und Instagram sind in Märkten wie Indien und Südostasien riesig.

- Diese Plattformen verbinden soziales Engagement mit einfachem Einkauf.

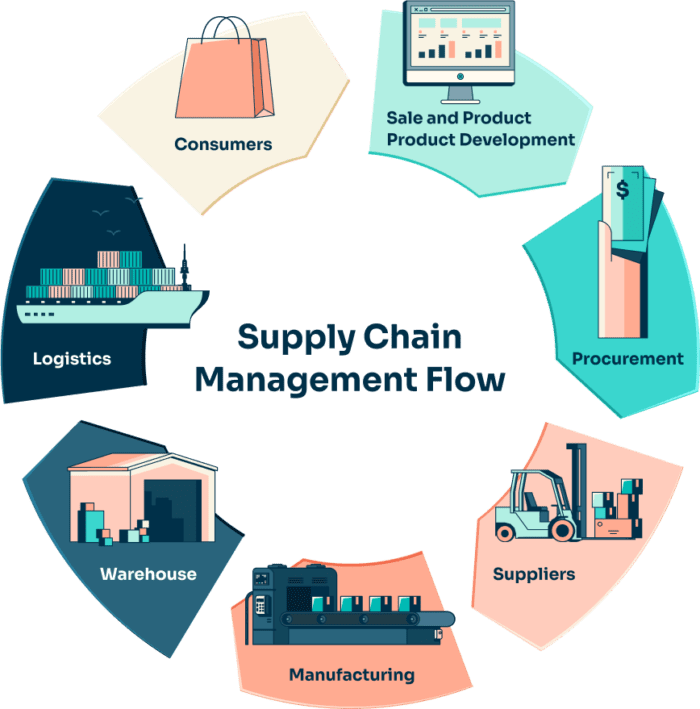

Herausforderungen bei Logistik und Fulfillment

Eine globale Expansion bringt logistische Hürden mit sich:

- Einhaltung der Zollvorschriften: In jedem Land gelten andere Regeln. Die Nichteinhaltung kann zu Verzögerungen oder zusätzlichen Kosten führen.

- Zustellung auf der letzten Meile: Eine schlechte Infrastruktur kann die Lieferungen verzögern. Ein solider Plan verbessert die Zufriedenheit.

- Regionale Lagerhäuser: Lokale Lager beschleunigen die Lieferung und senken die Versandkosten.

- 3PL-Partner: Logistikdienste von Drittanbietern (wie ShipStation) helfen bei der Lagerhaltung, dem Zoll und der Auslieferung, sodass Sie sich auf Ihr Wachstum konzentrieren können.

Lokale Gesetze und Compliance

Wachstum bringt rechtliche Verpflichtungen mit sich. Zu den wichtigsten Bereichen gehören:

- Steuern und Einfuhrzölle: Sie variieren je nach Land und wirken sich auf die Preisgestaltung aus. Wer die Vorschriften einhält, vermeidet Bußgelder und sorgt für hohe Gewinne.

- Datenschutz: Vorschriften wie die GDPR erfordern einen sorgfältigen Umgang mit Kundendaten. Die Einhaltung dieser Vorschriften schafft Vertrauen und vermeidet rechtlichen Ärger.

Wie man vom globalen Wachstum profitiert

Online-Marktplätze den elektronischen Handel dominieren. Im Jahr 2024, 83% von Käufern benutzten sie. Fast 48% werden sie im Jahr 2025 verstärkt eingesetzt.

Warum Marktplätze helfen:

- Eingebauter Kundenstamm

- Starkes Markenvertrauen

- Fulfillment-Dienste vereinfachen den Versand

Warum DTC (direct-to-consumer) auch funktioniert:

- Volle Kontrolle über Kundenerfahrung und Daten

- Höhere Gewinnspannen - keine Marktplatzgebühren

- Personalisierte Angebote und Kundenbindungsprogramme

Lokal gehen, um global zu gehen

Partnerschaften mit lokalen Logistikanbietern können einen entscheidenden Unterschied machen. Sie:

- Verstehen der lokalen Gepflogenheiten und der Herausforderungen bei der Lieferung

- Beschleunigung des Versands und Abwicklung von Rücksendungen

- Hilfe bei der Einhaltung von Vorschriften

Andere "local-first"-Taktiken:

- Sprachlokalisierung: Die Kommunikation in der Landessprache schafft Vertrauen.

- Regionales Marketing: Maßgeschneiderte Kampagnen verbessern den Kontakt und die Relevanz.

- Personalisiertes Einkaufen: Nutzen Sie Daten, um gezielt Produkte und Rabatte anzubieten.

Nutzen Sie Social Commerce und globale Marktplätze

Um internationale Zielgruppen zu erreichen, verwenden Sie:

- Soziale Plattformen: TikTok und Instagram sind jetzt Shopping-Tools.

- Marktplätze: Plattformen wie Amazon ermöglichen einen einfachen Zugang zu internationalen Käufern, ohne dass Sie ein eigenes Logistiknetz benötigen.

Die aufstrebenden Märkte sind begierig darauf, neue Technologien zu übernehmen, und die Regierungen unterstützen das Wachstum des elektronischen Handels. Ein früher Einstieg verschafft Ihnen einen Wettbewerbsvorteil.

Der ShipStation Ecommerce Delivery Benchmark Report 2025 ist ein hervorragendes Hilfsmittel für Ihre Expansion. Nutzen Sie ihn, um die richtigen Märkte auszuwählen, einen Plan für die lokale Zustellung zu erstellen und mit den richtigen Abwicklungsexperten zusammenzuarbeiten.

Einblicke in die Industrie

Nachrichten über den Posteingang

Nulla turp dis cursus. Integer liberos euismod pretium faucibua