Schlüsselelemente eines Trade Compliance Management Systems

In der heutigen, immer komplexer werdenden globalen Handelsumgebung ist die Einhaltung von Vorschriften nicht mehr optional, sondern unerlässlich. Unternehmen, die an internationalen Transaktionen beteiligt sind, müssen sich in einem Netz von Import-/Exportgesetzen, Sanktionen und Dokumentationsanforderungen zurechtfinden. Eine gut strukturierte Trade Compliance Management System minimiert nicht nur das rechtliche und finanzielle Risiko, sondern sorgt auch für einen reibungsloseren Ablauf über die Grenzen hinweg.

In diesem Artikel werden die entscheidenden Komponenten eines erfolgreichen Rahmens für das Management der Einhaltung von Handelsbestimmungen beschrieben, der die Verantwortlichkeit, Transparenz und Flexibilität des Unternehmens unterstützt.

1. Klare Führungsstruktur und politischer Rahmen

Das Herzstück einer wirksamen Handelserfüllung Managementsystem ist ein klar definiertes Governance-Modell. Dazu gehört die Zuweisung von Verantwortlichkeiten an bestimmte Compliance-Beauftragte oder Abteilungen. Diese Funktionen sollten von der Unternehmensleitung unterstützt werden und in die allgemeine Risiko- und Ethikstrategie des Unternehmens eingebettet sein.

Die Ausarbeitung und Dokumentation von Richtlinien zur Einhaltung der Handelsbestimmungen ist ebenfalls von entscheidender Bedeutung. Diese Richtlinien sollten Folgendes umfassen:

- Klassifizierungen der Ausfuhrkontrolle

- Einfuhrlizenzverfahren

- Protokolle zur Überprüfung verweigerter Parteien

- Aufbewahrungspflichten

Schriftliche Richtlinien bilden die Grundlage für einheitliche und rechtlich vertretbare Geschäftspraktiken.

2. Robuste Risikobewertungsprozesse

Eine erfolgreiche Compliance-Strategie beginnt mit einem proaktiven Verständnis der Risiken. Unternehmen müssen regelmäßig ihre Exposition gegenüber handelsbezogenen Risiken in allen Geschäftsbereichen, Märkten und Lieferketten. Dazu gehört die Bewertung:

- An den Transaktionen beteiligte Länder

- Produktklassifizierungen nach dem Harmonisierten Tarifsystem (HTS) oder ECCN-Codes

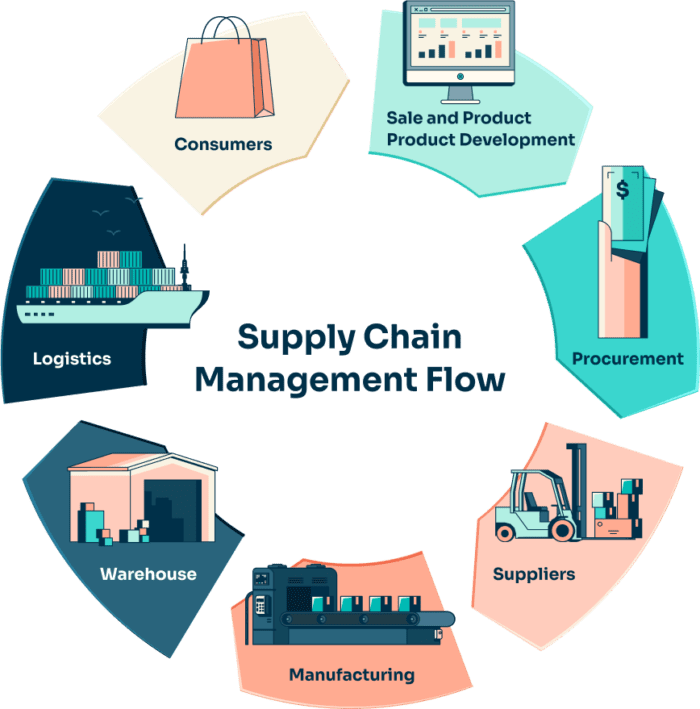

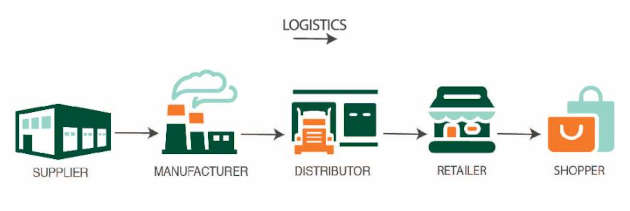

- Partner und Vermittler aus der ganzen Welt Logistikkette

Risikobewertungen sollten keine einmaligen Übungen sein, sondern kontinuierliche Bemühungen, die in den Entscheidungsprozess integriert werden. Sie helfen den Unternehmen, den Änderungen der Vorschriften voraus zu sein und ihre Strategien bei Bedarf anzupassen.

3. Wirksame Screening- und Klassifizierungskontrollen

Automatisierte Screening-Tools sind unerlässlich, um rote Fahnen zu erkennen, bevor Transaktionen stattfinden. Dazu gehören:

- Überprüfung von Parteien anhand der von der Regierung herausgegebenen Listen mit eingeschränkten oder nicht zugelassenen Parteien

- Kennzeichnung von mit einem Embargo belegten Zielen

- Überwachung der Endverwendung oder der Anliegen der Endnutzer

Eine korrekte Produktklassifizierung ist ebenso wichtig. Eine falsche Klassifizierung von Waren kann zu einer Unter- oder Überzahlung von Zöllen, verzögerten Sendungen oder sogar zu Geldstrafen führen. Ein Managementsystem für die Einhaltung der Handelsbestimmungen sollte die korrekte Zuweisung von HS-Codes oder ECCN erleichtern, und es sollten Unterlagen aufbewahrt werden, die die Klassifizierungsentscheidungen unterstützen.

4. Schulungen und interne Sensibilisierungsprogramme

Selbst das beste Compliance-System kann scheitern, wenn die Mitarbeiter nicht wissen, wie es umgesetzt werden soll. Schulungsprogramme sind der Schlüssel zur Stärkung der Compliance-Kultur auf allen Organisationsebenen.

Wirksame Programme sollten sein:

- Rollenspezifisch, d. h. für unterschiedliche Risiken in den Bereichen Vertrieb, Logistik, Beschaffung und Recht

- Regelmäßige Aktualisierung auf der Grundlage regulatorischer Entwicklungen

- Interaktiv und szenariobasiert, um das Behalten zu fördern

Schulungen verringern nicht nur menschliches Versagen, sondern signalisieren auch das Engagement eines Unternehmens für ein verantwortungsvolles Handelsverhalten.

5. Technologieintegration und Automatisierung

Die moderne Einhaltung von Handelsbestimmungen erfordert moderne Werkzeuge. Die Automatisierung kann die Genauigkeit und Effizienz der Compliance-Bemühungen dramatisch verbessern, insbesondere in großen Organisationen mit einem hohen Transaktionsvolumen.

Technologische Lösungen können:

- Echtzeit-Screening durchführen

- Automatisierung der Dokumentenerstellung (z. B. Handelsrechnungen, Ursprungszeugnisse)

- Spur Zulassungsanforderungen und Ablaufdaten

- Integration mit ERP- und Logistiksystemen für eine durchgängige Überwachung der Compliance

Die Implementierung der richtigen Technologie sorgt für schnellere Arbeitsabläufe, weniger manuellen Aufwand und die konsequente Einhaltung von Regeln.

6. Fortlaufende Überwachung und Rechnungsprüfung

Die Einhaltung von Vorschriften ist keine Funktion, die man einfach mal so hinschmeißt und wieder vergisst. Laufende Überwachung und regelmäßige Audits sind unerlässlich, um Lücken zu erkennen, interne Kontrollen durchzusetzen und Prozesse auf der Grundlage der gewonnenen Erkenntnisse anzupassen.

Die Prüfungen sollten Folgendes umfassen:

- Stichproben von Vorgängen

- Überprüfung der Einhaltung der Politik

- Kontrolle der Aufbewahrung von Unterlagen

- Bewertung der ergriffenen Abhilfemaßnahmen

Eine proaktive Prüfung trägt dazu bei, die Wahrscheinlichkeit externer Durchsetzungsmaßnahmen zu verringern und die interne Widerstandsfähigkeit zu stärken.

7. Strenge Aufbewahrungspraktiken

Die Aufbewahrung von Aufzeichnungen ist mehr als nur die Ablage von Dokumenten - sie ist in den meisten Rechtsordnungen gesetzlich vorgeschrieben. Ein starkes Managementsystem für die Einhaltung von Handelsbestimmungen muss sicherstellen, dass alle Aufzeichnungen aufbewahrt werden:

- Genaue

- Leicht auffindbar

- Aufbewahrung für den gesetzlich vorgeschriebenen Zeitraum (oft 5-7 Jahre)

Dazu gehören Versand Dokumente, Lizenzen, Klassifizierungsbegründungen und Prüfprotokolle. Eine gute Aktenführung liefert die notwendigen Beweise für den Fall von behördlichen Untersuchungen oder Audits.

8. Reaktionspläne für Verstöße oder Zwischenfälle

Trotz bester Bemühungen kann es zu Verstößen kommen. Ein vorbereiteter Reaktionsplan stellt sicher, dass die Organisation mit solchen Situationen effizient und transparent umgeht. Der Plan sollte Folgendes festlegen:

- Interne Berichtswege

- Ermittlungsverfahren

- Protokolle über Abhilfemaßnahmen

- Kommunikationsleitlinien (intern und extern)

Das Vorhandensein eines solchen Plans stärkt die Verantwortlichkeit und positioniert das Unternehmen als kooperativ in jedem behördlichen Überprüfungsverfahren.

Schlussfolgerung

Ein effektives Managementsystem für die Einhaltung von Handelsbestimmungen ist keine einzelne Software oder Checkliste, sondern ein dynamisches, unternehmensweites Engagement für verantwortungsvolle und legale globale Handelspraktiken. Indem sie sich auf Governance, Risikobewusstsein, Automatisierung, Mitarbeiterschulung und kontinuierliche Verbesserung konzentrieren, können Unternehmen die Compliance einhalten und gleichzeitig die betriebliche Effizienz aufrechterhalten.

Für Unternehmen, die sich auf komplexen internationalen Märkten bewegen, ist der Aufbau und die Pflege einer abgerundeten Struktur zur Einhaltung von Handelsbestimmungen ein strategischer Vorteil und nicht nur eine gesetzliche Verpflichtung.

Einblicke in die Industrie

Nachrichten über den Posteingang

Nulla turp dis cursus. Integer liberos euismod pretium faucibua