¿Qué es el cumplimiento de las normas comerciales? Elementos clave, riesgos y buenas prácticas

La conformidad comercial significa seguir las normas y reglamentos cuando se envían mercancías de un país a otro. Garantiza que las empresas cumplan las leyes de los países exportadores e importadores.

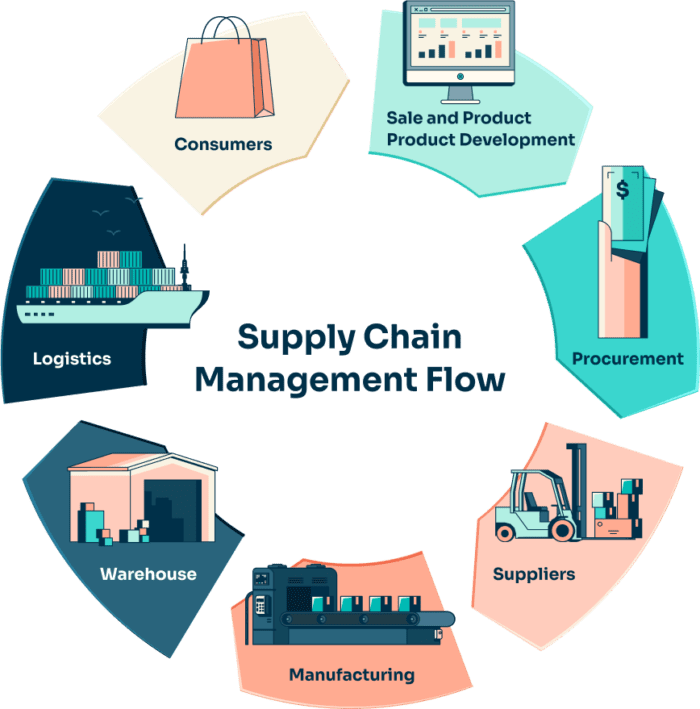

El cumplimiento de las normas comerciales afecta a muchas áreas del comercio internacional, y cada una de ellas requiere conocimientos específicos.

Es importante saber que las normas comerciales pueden variar según el país y el tipo de mercancías. Las empresas deben cumplir las normas de cada país en materia de política económica, ética, calidad de los productos, normas sobre proveedores y protección del consumidor.

¿Quién necesita entender el cumplimiento de la normativa comercial?

Cualquier empresa que exporte o importe bienes o servicios -por grande o pequeña que sea- necesita comprender y seguir las normas de cumplimiento de la normativa comercial.

Los empresarios son responsables de saber qué normas se les aplican. Es importante revisar periódicamente los procesos de comercio internacional para evitar errores.

Las empresas más grandes suelen tener equipos enteros que se centran en el cumplimiento de las normas comerciales. Estos equipos supervisan los cambios en las normas, identifican los países de alto riesgo y ayudan a reducir los riesgos legales y financieros de la empresa.

Contar con un sólido proceso de cumplimiento es importante. Infringir la legislación comercial puede acarrear retrasos, multas e incluso cargos penales.

¿Cuáles son las consecuencias del incumplimiento?

Las normas comerciales son cada vez más complejas, al igual que las sanciones por incumplirlas.

Las infracciones leves pueden causar retrasos en los envíos. Las infracciones graves pueden acarrear multas elevadas o incluso penas de cárcel.

El incumplimiento puede perjudicar las relaciones con los clientes y dañar la reputación de su empresa. También puede reducir los beneficios o limitar su capacidad de comerciar internacionalmente.

¿Cuáles son los elementos clave de la conformidad comercial?

Clasificación arancelaria

Clasificar correctamente sus mercancías es una parte fundamental del cumplimiento de la normativa. Afecta a los tipos impositivos, el control de las exportaciones, la concesión de licencias y los procedimientos aduaneros.

Las mercancías se clasifican utilizando el Sistema Armonizado (SA)-un sistema mundial con más de 5.000 categorías de productos, cada una con un código de seis dígitos. Este sistema lo utilizan más de 200 países y cubre 98% del comercio mundial.

Por qué es importante la clasificación arancelaria

- Es responsabilidad legal de exportadores e importadores.

- Ayuda a calcular los impuestos y aranceles correctos.

- Identifica si se necesitan permisos o licencias.

- Garantiza una documentación comercial normalizada.

- Permite disponer de estadísticas comerciales precisas para la planificación y las negociaciones.

- Los errores pueden provocar retrasos, multas o embargos.

Problemas de una clasificación incorrecta

- Las aduanas pueden marcar o investigar sus envíos.

- Los envíos podrían retrasarse o denegarse si faltan los documentos requeridos.

- Puede que pague demasiado o demasiado poco en derechos.

- Las aduanas no suelen reembolsar el exceso de derechos si pagas de más.

- Pagar de menos puede acarrear recargos y sanciones.

Normas de origen

En origen de las mercancías es clave para el cumplimiento y funciona junto con la clasificación arancelaria y la valoración.

Según la OMA, las normas de origen son utilizadas por los países para decidir de dónde "proceden" las mercancías mediante acuerdos nacionales o internacionales.

Hay dos tipos:

- Origen preferente: Para las mercancías a las que se aplican derechos reducidos o nulos en virtud de acuerdos comerciales.

- Origen no preferencial: Se utiliza para el control aduanero general, como las cuotas o las sanciones.

Por qué es importante determinar el origen

- Determina si las mercancías obtienen tipos impositivos más bajos.

- Afecta a los derechos antidumping o adicionales.

- Influye en que un producto pueda entrar en un país.

- Influye en la necesidad de permisos especiales.

- Ayuda a controlar las cuotas y las normas de etiquetado.

- Apoya la exactitud de los datos comerciales.

Valoración de mercancías

Conocer la valor de los bienes es esencial para calcular los impuestos a la importación y elaborar estadísticas comerciales.

En Acuerdo de la OMC sobre valoración en aduana establece seis métodos para determinar el valor. El más común es el valor de transacción-el precio real pagado por los bienes.

Si este precio no es aceptable, las aduanas pueden utilizar otros métodos aprobados en un orden específico.

Por qué es importante la valoración

- Afecta directamente a los costes de importación.

- Garantiza el pago de los impuestos y aranceles correspondientes.

- Los errores pueden provocar pagos excesivos (que perjudican a los beneficios) o insuficientes (que causan retrasos o multas).

Tipos de funciones

- Funciones específicas: En función de la cantidad (por ejemplo, $1 por unidad); no es necesaria valoración.

- Derechos ad valorem: En función del valor (por ejemplo, 5% del precio); debe declararse el valor en aduana.

Debido a la complejidad, muchos comerciantes solicitan resoluciones anticipadas de aduanas para confirmar la valoración correcta.

Gestión aduanera

Gestión aduanera garantiza el cumplimiento de toda la normativa para que las mercancías puedan circular por las fronteras sin problemas.

Muchos países utilizan sistemas de gestión aduanera para agilizar el comercio, reducir costes y garantizar el cumplimiento de las responsabilidades legales. Estos sistemas ayudan a:

- Tratamiento de documentos

- Clasificación

- Coordinación del tránsito

- Comunicación digital

Gestión de licencias

Algunas mercancías necesitan licencias de importación o exportación. Estos requisitos varían según el país y el tipo de producto.

Los artículos controlados pueden incluir:

- Armas o artículos militares

- Productos químicos y medicamentos

- Arte, plantas o animales

Exportar o importar sin la licencia requerida es ilegal. Las mercancías pueden ser retenidas, confiscadas o destruidas.

Ejemplos

- Permisos/Licencias: Obligatorio para muchas mercancías controladas.

- Certificados de conformidad: Garantizar la seguridad del producto.

- Inspecciones previas a la expedición: Verificar las normas del producto.

- Controles sanitarios y veterinarios: Necesario para animales vivos o productos alimenticios.

Control de las exportaciones

Como los controles de importación, controles de exportación obligan a las empresas a cumplir leyes específicas cuando envían mercancías al extranjero.

Algunas mercancías son doble uso-pueden utilizarse tanto para fines civiles como militares- y están sujetos a normas estrictas. Otros (como la madera o la mantequilla de cacahuete) también pueden requerir permisos especiales de exportación.

Los comerciantes deben:

- Clasificar correctamente las mercancías

- Conocer el país de destino

- Compruebe si necesita permisos

Violar las leyes de control de las exportaciones puede acarrear multas severas o penas de cárcel.

Proyección

Proyección ayuda a las empresas a evitar comerciar con personas u organizaciones prohibidas o de alto riesgo.

Se trata de cotejar los datos de clientes y proveedores con las listas de vigilancia gubernamentales. El control ayuda a evitar:

- Incumplimiento de sanciones o embargos

- Hacer negocios con partes políticamente expuestas o delictivas

Debe realizarse un cribado:

- Al inicio de una nueva asociación

- Antes de cada transacción importante

- Regularmente, para socios permanentes

No realizar los controles adecuadamente puede acarrear problemas legales y económicos.

Reglas Incoterms

Incoterms son normas comerciales mundiales creadas por la Cámara de Comercio Internacional (CCI).

Definen quién es responsable de qué en un contrato de venta, como quién paga los gastos de envío o quién se encarga de las aduanas.

Conocer y utilizar los Incoterms correctos ayuda a evitar confusiones y disputas. Estos términos deben figurar claramente en los documentos de envío.

Principales conclusiones

El cumplimiento de las normas comerciales implica muchos pasos importantes. Al importar mercancías, las empresas deben:

- Utilice el código arancelario del Sistema Armonizado.

- Declarar la correcta país de origen.

- Informe cantidad y valor de mercancías.

- Enumerar con precisión tarifas, costesy precios.

Componentes básicos de un buen programa de cumplimiento de las normas comerciales

Equipo de cumplimiento de las normas comerciales

Las empresas deben contar con un equipo responsable de comprender y cumplir la legislación comercial. El tamaño depende del volumen de comercio internacional de la empresa, pero el equipo debe tener las competencias adecuadas.

El equipo debe centrarse en:

- Creación de una política de cumplimiento

- Mantenimiento de registros

- Clasificar correctamente los productos

- Redacción de manuales y procedimientos operativos normalizados

- Formación del personal

- Estar al día de los cambios legislativos

- Control del cumplimiento de la normativa

Manual de cumplimiento de las normas comerciales

A manual de cumplimiento debe documentar todas las políticas y procedimientos de la empresa. Así se garantiza que todos sigan las mismas normas y se contribuye a cumplir los requisitos legales.

Debe incluir:

- Política aduanera

- Responsabilidades del personal

- Pasos de importación/exportación

- Controles internos (como el cribado)

- Procedimientos de registro

- Normas especiales de la empresa

Revisión interna

Incluso con un manual en su lugar, regular revisiones internas son necesarios para comprobar si todo funciona correctamente y está actualizado.

Una buena revisión debe incluir:

- Calendarios de pruebas (por ejemplo, mensuales o trimestrales)

- Revisar suficientes muestras

- Cotejo de los registros financieros y de envío

- Solucionar cualquier problema (por ejemplo, volver a formar al personal o actualizar el manual).

Lista de consideraciones

A la hora de implantar un programa de cumplimiento de las normas comerciales, debe tener en cuenta lo siguiente:

Perspectivas del sector

noticias vía inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua

[...] en la economía globalizada de hoy en día, el cumplimiento de las normas comerciales se ha convertido en un reto operativo crítico para las empresas de todos los sectores. Según [...]