Elementos clave de un sistema de gestión de la conformidad comercial

En el entorno comercial mundial actual, cada vez más complejo, el cumplimiento de la normativa ya no es opcional, sino esencial. Las empresas que realizan transacciones internacionales deben navegar por una red de leyes de importación y exportación, sanciones y requisitos de documentación. Un sistema bien estructurado gestión del cumplimiento de las normas comerciales no sólo minimiza el riesgo legal y financiero, sino que también garantiza la fluidez de las operaciones transfronterizas.

En este artículo se describen los componentes esenciales de un marco eficaz de gestión de la conformidad comercial que favorezca la responsabilidad, la transparencia y la agilidad de la organización.

1. Estructura de gobierno y marco político claros

En el centro de una cumplimiento de las normas comerciales es un modelo de gobernanza claramente definido. Esto incluye asignar responsabilidades a los responsables o departamentos de cumplimiento designados. Estas funciones deben contar con el apoyo de la dirección ejecutiva e integrarse en la estrategia general de riesgos y ética de la empresa.

También es crucial desarrollar y documentar políticas de cumplimiento de las normas comerciales. Estas políticas deben abarcar:

- Clasificaciones del control de las exportaciones

- Procedimientos de concesión de licencias de importación

- Protocolos de detección de partes rechazadas

- Obligaciones de registro

Las políticas escritas constituyen la base de unas prácticas comerciales coherentes y jurídicamente defendibles.

2. Procesos sólidos de evaluación de riesgos

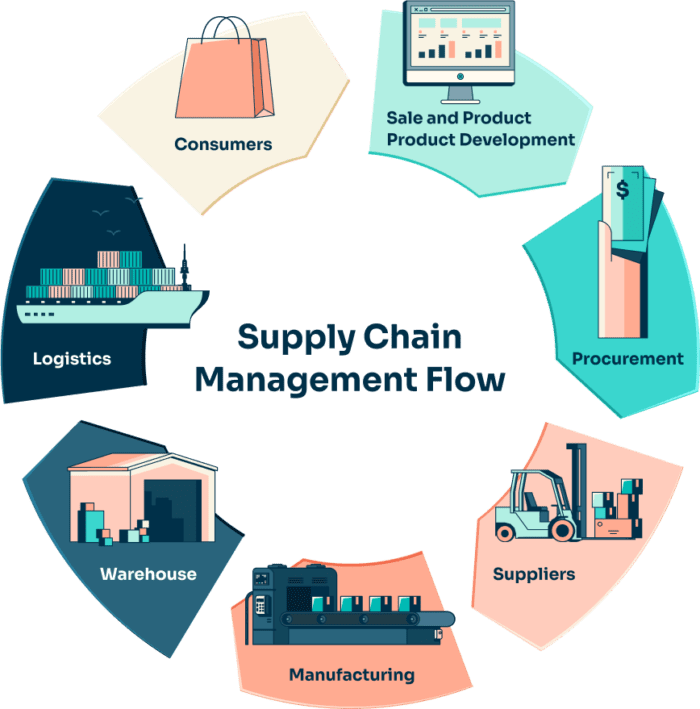

Una estrategia de cumplimiento eficaz comienza con una comprensión proactiva del riesgo. Las empresas deben evaluar periódicamente su exposición a los riesgos relacionados con el comercio en todas sus operaciones, mercados y mercados. cadenas de suministro. Esto incluye la evaluación:

- Países implicados en las transacciones

- Clasificaciones de los productos en la nomenclatura arancelaria armonizada (HTS) o códigos ECCN

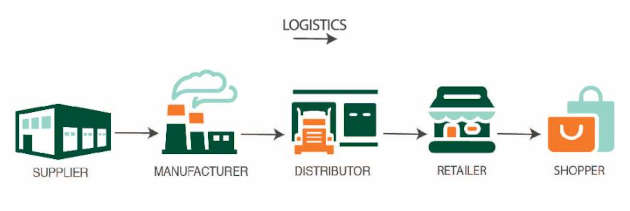

- Socios e intermediarios de todo el cadena logística

Las evaluaciones de riesgos no deben ser ejercicios puntuales, sino esfuerzos continuos integrados en el proceso de toma de decisiones. Ayudan a las organizaciones a anticiparse a los cambios normativos y a ajustar las estrategias según sea necesario.

3. Controles eficaces de selección y clasificación

Las herramientas de detección automatizada son esenciales para identificar las señales de alarma antes de que se produzcan las transacciones. Esto incluye:

- Comprobación de los partidos en las listas de partidos restringidos o denegados publicadas por el Gobierno

- Marcar destinos embargados

- Seguimiento de las preocupaciones de los usuarios finales

La correcta clasificación de los productos es igualmente vital. Una clasificación errónea de las mercancías puede dar lugar a un pago insuficiente o excesivo de derechos, retrasos en los envíos o incluso multas. Un sistema de gestión del cumplimiento de las normas comerciales debe facilitar la asignación correcta de códigos del SA o ECCN, y debe conservarse la documentación que respalde las decisiones de clasificación.

4. Programas de formación y sensibilización interna

Incluso el sistema de cumplimiento mejor diseñado puede fracasar si los empleados no saben cómo aplicarlo. Los programas de formación son fundamentales para reforzar la cultura de cumplimiento en todos los niveles de la organización.

Los programas eficaces deben serlo:

- Específicos para cada función, abordan diferentes riesgos para los equipos de ventas, logística, compras y jurídico.

- Actualización periódica en función de la evolución de la normativa

- Interactivo y basado en escenarios para fomentar la retención

La formación no sólo reduce los errores humanos, sino que también indica el compromiso de una empresa con un comportamiento comercial responsable.

5. Integración tecnológica y automatización

El cumplimiento de la normativa comercial moderna requiere herramientas modernas. La automatización puede mejorar drásticamente la precisión y la eficiencia de los esfuerzos de cumplimiento, especialmente en grandes organizaciones con grandes volúmenes de transacciones.

Las soluciones tecnológicas pueden:

- Realizar un cribado en tiempo real

- Automatizar la generación de documentos (por ejemplo, facturas comerciales, certificados de origen)

- Pista requisitos de autorización y fechas de expiración

- Integración con los sistemas ERP y logísticos para controlar el cumplimiento de principio a fin

La implantación de la tecnología adecuada garantiza flujos de trabajo más rápidos, menos esfuerzo manual y un cumplimiento coherente de las normas.

6. Control y auditoría continuos

El cumplimiento de la normativa no es una función de "todo listo". La supervisión continua y las auditorías periódicas son esenciales para detectar lagunas, reforzar los controles internos y ajustar los procesos en función de las lecciones aprendidas.

Las auditorías deben incluir:

- Muestreo de transacciones

- Revisiones del cumplimiento de las políticas

- Controles de conservación de registros

- Evaluación de las medidas correctoras adoptadas

La auditoría proactiva ayuda a reducir la probabilidad de acciones externas para hacer cumplir la normativa y refuerza la resistencia interna.

7. Sólidas prácticas de mantenimiento de registros

El mantenimiento de registros es algo más que almacenar documentos: es un requisito legal en la mayoría de las jurisdicciones. Un sistema sólido de gestión de la conformidad comercial debe garantizar que todos los registros:

- Preciso

- Fácilmente recuperable

- Conservados durante el periodo legalmente establecido (a menudo entre 5 y 7 años).

Esto incluye envío documentos, licencias, justificaciones de clasificación y registros de control. Un buen mantenimiento de registros proporciona las pruebas necesarias en caso de investigaciones o auditorías gubernamentales.

8. Planes de respuesta a infracciones o incidentes

A pesar de todos los esfuerzos, pueden producirse infracciones. Un plan de respuesta preparado garantiza que la organización gestione estas situaciones con eficacia y transparencia. El plan debe definir:

- Canales internos de información

- Procedimientos de investigación

- Protocolos de medidas correctoras

- Directrices de comunicación (interna y externa)

Contar con un plan de este tipo refuerza la responsabilidad y posiciona a la empresa como cooperadora en cualquier proceso de revisión reglamentaria.

Conclusión

Un sistema eficaz de gestión de la conformidad comercial no es un programa informático o una lista de comprobación, sino un compromiso dinámico de toda la organización con unas prácticas comerciales globales responsables y legales. Al centrarse en la gobernanza, la concienciación sobre los riesgos, la automatización, la formación de los empleados y la mejora continua, las empresas pueden cumplir la normativa sin perder eficacia operativa.

Para las organizaciones que navegan por mercados internacionales complejos, la creación y el mantenimiento de una estructura de cumplimiento de las normas comerciales bien estructurada es una ventaja estratégica, no sólo una obligación reglamentaria.

Perspectivas del sector

noticias vía inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua