Le fret aérien de la Chine vers les États-Unis risque d'être touché par $22B en raison de la fin de l'exemption de minimis

Une tempête parfaite se prépare pour l'industrie mondiale du fret aérien, et elle commence par un changement de politique commerciale. Début 2 mai 2025Le gouvernement américain éliminera exemptions de minimis en franchise de droits pour les envois chinois de faible valeur et imposer une Tarif 145% sur toutes les importations chinoises. Le résultat ? Une taxe estimée à $22 milliards d'euros de perte de recettes pour le fret aérien au cours des trois prochaines années et un possible effondrement de l'Union européenne. direct au consommateur (D2C) qui a propulsé les géants chinois du commerce électronique tels que le Temu et Shein.

1. Le choc de $22 milliards pour le fret aérien

Selon Cirrus Global Advisors, société de conseil en commerce électronique et en logistique, l'annulation des avantages de minimis et l'introduction de droits de douane punitifs entraîneront une baisse des recettes du fret aérien entre les États-Unis et la Chine. chute de plus de 30%. Les dommages sont dus à :

- Réduction des volumes d'expédition

- Capacité excédentaire de transport de marchandises

- Forte baisse du rendement par parcelle

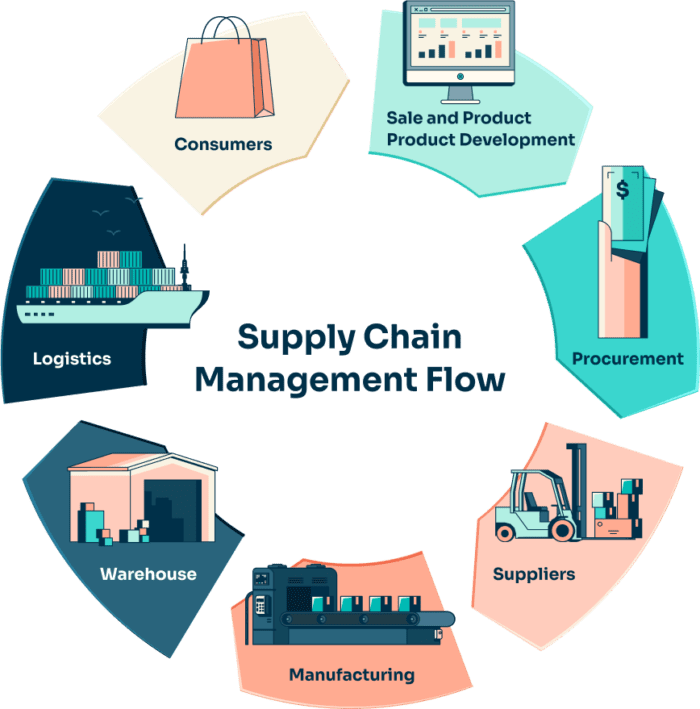

Ce coup dur sera ressenti tout au long de la chaîne d'approvisionnement, en particulier par les compagnies aériennes de transport de fret telles que Atlas Air et des prestataires de services logistiques tels que Logistique Apexqui dépendent fortement du fret électronique en provenance de Chine.

2. De Minimis : De la commodité à la crise

Le règle de minimis permettait auparavant aux consommateurs américains d'importer jusqu'à $800 par jour, hors taxesavec un minimum de documentation. Il a permis à de petits vendeurs chinois d'expédier directement leurs produits aux particuliers américains, avec des frais généraux réduits et un traitement rapide des commandes.

Mais les critiques ont affirmé que le système était utilisé de manière abusive :

- Contrebande de fentanyl et de produits de contrefaçon

- Surveillance douanière minimale

- Avantages déloyaux pour les vendeurs étrangers

Le Tarif 145% remplace désormais la franchise de droits, obligeant les commerçants à déposer des déclarations en douane officielles, une procédure longue et coûteuse.

3. L'effondrement du modèle D2C

Les plateformes de commerce électronique telles que Temu et Shein s'efforcent de s'adapter. Alors que certains grands acteurs construisent des centres d'exécution basés aux États-Unis pour leurs clients, d'autres s'efforcent de s'adapter. B2B2C des opérations, des dizaines de milliers de petits marchands chinois ne disposent pas des infrastructures ou des capitaux nécessaires pour s'adapter.

Fondateur de Cirrus Global, Derek Lossing, met en garde :

"Le modèle D2C chinois ne survivra pas à ces niveaux tarifaires. Seul l'avenir nous le dira, mais l'impact pourrait être catastrophique".

Principales implications financières :

- Les frais de traitement douanier passent de $0,10 à $3 par envoi

- $50 éléments confrontés à $31 de paperasserie et de frais de courtage

- Retards dans le traitement douanier des envois de fret aérien

4. Les tarifs douaniers perturbent les consommateurs et les détaillants

Temu et Shein l'ont déjà fait :

- Augmentation des prix

- Réduire la publicité aux États-Unis

- Avertir les clients des coûts à venir

Dans le même temps, les consommateurs américains sont se précipiter pour acheter avant le 2 maice qui crée de la volatilité dans les volumes de fret aérien.

Ajouter au chaos :

- FedEx a ajouté un $0.45/lb supplément en raison de l'afflux d'envois avant la date limite

- De nombreuses entreprises de logistique font désormais pression pour Modèles de dégagement B2B2C pour survivre à la nouvelle charge douanière

5. Protection de la vie privée et difficultés de paiement : Un nouvel obstacle

Les nouvelles règles impliquent que davantage de données doivent être collectées lors du passage en caisse.y compris les informations personnelles sensibles-pour remplir les déclarations en douane.

Lossing pose une question cruciale :

"Dans quelle mesure les acheteurs américains se sentiront-ils à l'aise pour saisir des données personnelles sur des sites web chinois juste pour acheter un T-shirt $10 ?

Cette "friction au passage en caisse" pourrait encore réduire les ventes transfrontalières, ce qui aggraverait l'effondrement des recettes dans le secteur du fret aérien.

6. Un changement dans la structure du commerce mondial

Les effets combinés de :

- Tarifs

- Complexité douanière

- Tarifs d'expédition plus élevés

...sont susceptibles de détourner le commerce de la Chine. Des pays comme Vietnam et Inde devraient en bénéficier, car les marques recherchent des centres de production à droits de douane moins élevés.

Simultanément, les transporteurs express peuvent :

- Retrait anticipé des avions

- Annulation des vols à destination de la Chine

- Repositionner la capacité vers de nouveaux marchés

Si L'Europe Si la Commission européenne met en œuvre son plan de suppression de la règle de minimis pour les marchandises relevant de la catégorie $170, le modèle mondial de logistique du commerce électronique pourrait devoir être complètement réinventé.

Conclusion : La fin d'une ère pour le commerce de détail en Chine

La prochaine Changement de politique le 2 mai pourrait marquer la fin d'une époque. Ce qui faisait autrefois le succès de la Le commerce électronique entre la Chine et les États-Unis est rapide, bon marché et sans friction se transforme aujourd'hui en un processus complexe, coûteux et lourd en termes de conformité.

Bien que certaines grandes plateformes puissent s'adapter, les petits vendeurs, les opérateurs de fret aérien et les modèles d'exécution D2C sont gravement menacés. Cette politique, motivée par des raisons commerciales, sécuritaires et économiques, pourrait remodeler l'avenir de la logistique du commerce électronique mondial.

Appel à l'action

Restez informé de l'évolution des politiques commerciales et de leur impact sur le commerce électronique et la logistique mondiale. Suivez notre blog pour obtenir des informations sur :

- Mise à jour sur le commerce entre les États-Unis et la Chine

- Règles douanières mondiales

- Stratégies de commerce électronique transfrontalier

Aperçu de l'industrie

nouvelles via la boîte de réception

Nulla turp dis cursus. Integer liberos euismod pretium faucibua