Le piège caché des taxes internationales et la façon dont l'intégration des transports maritimes le résout

Le commerce électronique mondial se développe rapidement, mais les taxes internationales restent un obstacle majeur. Les droits de douane, la TVA et les tarifs douaniers transforment souvent les opportunités en revers coûteux, nuisant aux marges bénéficiaires et à la confiance des clients. Les acheteurs refusent les commandes en raison de frais inattendus, tandis que les entreprises sont confrontées à des amendes et à des retards.

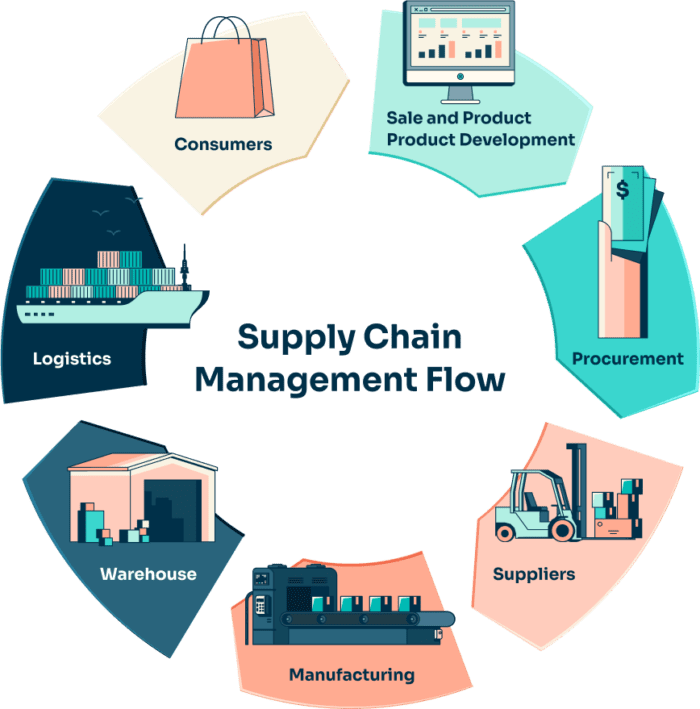

Intégration de l'expédition pour le commerce électronique résout ce problème en regroupant le calcul des taxes, les formalités douanières et les systèmes des transporteurs en un seul processus rationalisé, ce qui réduit les risques et permet aux acheteurs internationaux de bénéficier d'une expérience plus fluide.

Pourquoi les taxes internationales sont-elles un tel piège ?

Les règles fiscales sont-elles uniformes dans le monde entier ?

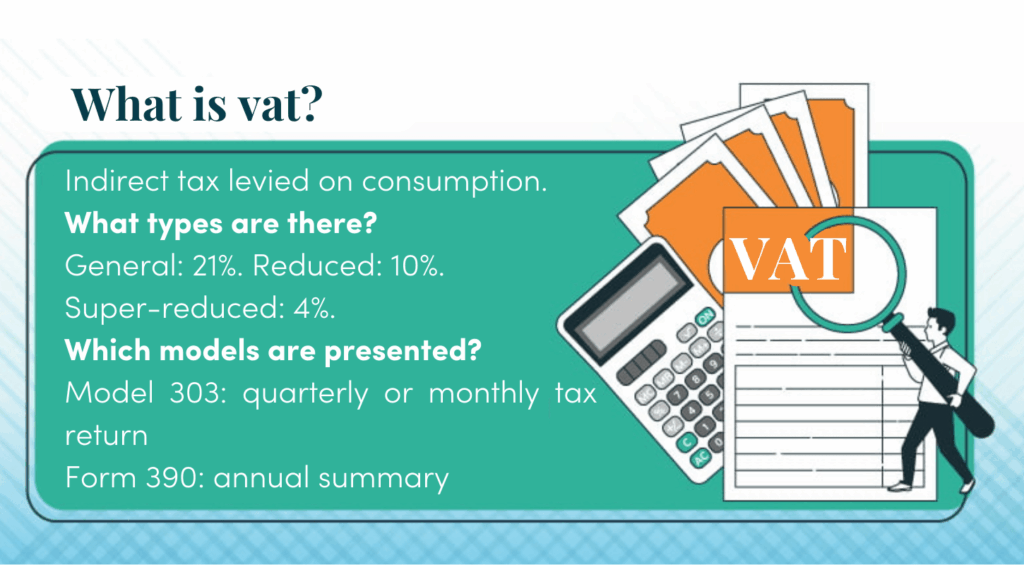

Loin de là. Chaque pays applique ses propres réglementations, ce qui rend la mise en conformité extrêmement complexe. Même au sein de régions apparemment unifiées, comme l'Union européenne, les entreprises se heurtent à des différences dans les pourcentages de TVA, les exonérations et les seuils d'importation.

Les défis les plus courants sont les suivants :

- Catégories d'impôts multiples: TVA, TPSles droits de douane et les accises.

- Seuil de confusion: Les exemptions pour les petites valeurs varient d'un marché à l'autre.

- Mises à jour constantes: Les gouvernements révisent souvent les politiques fiscales sans préavis.

- Complexité manuelle: Chaque produit a besoin du code HS correct pour être classé.

Sans automatisation, les vendeurs s'exposent à des retards d'expédition, à des pénalités et à des litiges coûteux avec les clients.

Comment les pièges fiscaux influencent-ils la croissance du commerce électronique ?

Les taxes imprévues nuisent-elles à la satisfaction des clients ?

Oui. Lorsque les acheteurs sont invités à payer les droits de douane à la livraison, ils se sentent induits en erreur. Nombre d'entre eux refusent la commande ou publient des commentaires négatifs. Ce piège caché crée une réaction en chaîne :

- L'abandon de panier augmente parce que les clients craignent les coûts cachés.

- Augmentation des coûts opérationnels car les transporteurs appliquent des frais de service pour le traitement douanier.

- Les retours s'accumulentLes entreprises sont donc contraintes d'absorber des pertes supplémentaires en matière d'expédition et de fiscalité.

- Les flux de trésorerie souffrent lorsque les vendeurs couvrent les droits à l'avance sans remboursement rapide.

- L'expansion mondiale ralentitL'incertitude rend l'entrée sur de nouveaux marchés risquée.

Le résultat est clair : une mauvaise gestion fiscale limite directement la croissance du commerce électronique.

Où intervient l'intégration de l'expédition pour le commerce électronique ?

L'intégration peut-elle simplifier la transparence fiscale ?

Oui. Avec Intégration de l'expédition pour le commerce électroniqueLes vendeurs bénéficient d'un calcul des taxes en temps réel au moment du paiement. Les clients ont ainsi l'assurance de connaître le coût total du produit, y compris les droits de douane, la TVA et les frais de traitement, avant de procéder au paiement.

Les principaux avantages sont les suivants :

- Calcul automatisé des droits: Evite les surprises à la livraison.

- Correspondance des codes SH: Assurer une classification précise des produits.

- Mises à jour dynamiques: Reflète immédiatement les changements de règles.

- Papiers numériques: Génère automatiquement les factures et déclarations douanières.

Ce processus permet de réduire les litiges, d'instaurer un climat de confiance et d'assurer la circulation des marchandises.

Quel rôle joue l'automatisation dans la conformité fiscale ?

Les entreprises peuvent-elles raisonnablement gérer les impôts manuellement ?

Pas une fois que les ventes dépassent une poignée d'envois. La manipulation manuelle introduit des risques à chaque étape : codes oubliés, formulaires incomplets ou taux d'imposition obsolètes. L'automatisation par l'intégration élimine ces problèmes :

- Formulaires douaniers pré-remplis avec des données sur les produits.

- Synchronisation automatique des UGS, des descriptions et des codes entre les différents canaux.

- Création instantanée de factures conformes.

- Visibilité en temps réel des droits perçus et à payer.

En éliminant l'erreur humaine, l'automatisation réduit les délais et garantit la conformité avec les autorités fiscales internationales.

Comment l'intégration améliore-t-elle l'expérience client ?

Pourquoi les clients apprécient-ils la clarté fiscale ?

La transparence est essentielle dans le commerce de détail en ligne. Un acheteur qui se heurte à des droits cachés perd confiance dans la marque. À l'inverse, les magasins qui incluent les taxes d'emblée créent un sentiment de fiabilité.

Les avantages directs pour les acheteurs sont les suivants

- Confiance: La connaissance du prix final permet d'éviter les chocs de paiement.

- Commodité: Les taxes sont prépayées et la livraison se fait sans problème.

- Satisfaction: Des reçus clairs réduisent les plaintes et les demandes de remboursement.

- Loyauté: Les acheteurs reviennent vers les vendeurs qui proposent des prix honnêtes et prévisibles.

Dans le domaine du commerce électronique, les expériences positives des clients se traduisent directement par des commandes répétées et des recommandations de bouche à oreille.

Qu'en est-il du passage à l'échelle transfrontalière ?

L'intégration permet-elle une expansion internationale rapide ?

Oui. Pour les entreprises qui cherchent à atteindre de nouvelles régions, l'intégration élimine la nécessité d'une longue configuration manuelle. Au lieu de rechercher chaque règle indépendamment, les vendeurs s'appuient sur des systèmes automatisés.

Les avantages pratiques sont les suivants

- Modèles de marché: Les profils fiscaux s'adaptent automatiquement à la destination.

- Flexibilité des transporteurs: Connectez-vous avec DHL, FedEx, UPS ou les transporteurs régionaux en toute transparence.

- Rationalisation des déclarations: Les étiquettes conformes à la législation fiscale réduisent les litiges et les pertes.

- Tableaux de bord centralisés: Visualiser toutes les obligations, les taxes et les expéditions dans une seule interface.

Cette souplesse opérationnelle permet aux vendeurs de se lancer dans de nouveaux pays plus rapidement et avec moins d'erreurs.

L'intégration de l'expédition pour le commerce électronique est-elle financièrement avantageuse ?

L'intégration permet-elle d'économiser de l'argent à long terme ?

Absolument. Si l'investissement initial peut sembler élevé, le retour sur investissement est évident :

- Réduction des coûts de personnel grâce à l'automatisation des contrôles fiscaux manuels.

- Éviter les amendes et les pénalités dues à des déclarations incorrectes.

- Moins de commandes abandonnées et de retours dus à des frais inattendus.

- Amélioration du flux de trésorerie grâce à une perception précise et immédiate des impôts.

- Diminuer les frais de transport en réduisant les erreurs et les réexpéditions.

Au fil du temps, l'intégration ne se contente pas de protéger les revenus, elle augmente activement la rentabilité.

Quels sont les risques de non-conformité pris en compte ?

Comment l'intégration réduit-elle l'exposition aux problèmes juridiques ?

Le commerce électronique transfrontalier est soumis à une pression réglementaire croissante. Les agences fiscales sont de plus en plus strictes, et même des erreurs mineures peuvent entraîner le blocage des envois ou des pénalités financières. Avec l'aide de l Intégration de l'expédition pour le commerce électronique:

- Les règles sont mises à jour automatiquement en temps réel.

- Les déclarations en douane sont conformes aux dernières réglementations locales.

- Des dossiers précis sont archivés pour les audits et les rapports financiers.

En garantissant la conformité, l'intégration ne réduit pas seulement le risque juridique, mais renforce également la réputation de la marque sur les marchés internationaux.

Scénario du monde réel : Un détaillant de mode s'internationalise

Un détaillant de mode basé aux États-Unis s'étend à l'Europe et à l'Asie. Sans intégration :

- Les acheteurs allemands sont confrontés à des frais de TVA surprenants lors de la livraison.

- Les douanes japonaises retardent les envois en raison de l'absence de codes HS.

- Les retours coûtent à l'entreprise des milliers de dollars en frais d'expédition et de retraitement.

Avec intégration :

- Les droits de douane et la TVA sont clairement affichés au moment du paiement.

- Les documents douaniers dématérialisés accélèrent le dédouanement.

- Des tableaux de bord unifiés permettent de suivre les obligations dans toutes les régions.

Ce processus rationalisé favorise une expansion rentable tout en préservant la satisfaction des clients.

Meilleures pratiques pour l'intégration de l'expédition dans le commerce électronique

Quelles sont les étapes qui garantissent le succès ?

- Choisir la bonne plateforme: Utilisez des fournisseurs de confiance tels que Postalparcel pour une intégration complète de l'expédition et des taxes.

- Classer les produits avec précision: Attribuer les bons codes SH pour éviter les retards douaniers.

- Piloter avant de passer à l'échelle: Tester les nouveaux marchés avec un petit déploiement pour vérifier la conformité.

- Communiquer clairement: Affichez les prix TTC et assurez la transparence des reçus.

- Mise à jour continue: Réviser régulièrement les processus pour tenir compte des nouvelles lois.

- Utiliser l'intégration multi-transporteurs: Offrir aux clients des choix de livraison sans ajouter de complexité.

- Maintenir des pistes d'audit: Stocker les données fiscales numériques pour les rapports et les contrôles de conformité.

Ces pratiques garantissent des opérations plus fluides et réduisent les risques lors de la croissance transfrontalière.

Conclusion

Les taxes internationales sont un piège caché qui prend au dépourvu de nombreuses entreprises de commerce électronique. Des taxes inattendues, des réglementations confuses et des risques de non-conformité peuvent freiner l'expansion et nuire à la confiance des clients. Pourtant, il est possible de résoudre ces problèmes.

Avec le bon Intégration de l'expédition pour le commerce électroniqueLes vendeurs automatisent le calcul des taxes, simplifient les procédures douanières et présentent aux acheteurs des coûts exacts au débarquement. Cela renforce la transparence, réduit les problèmes opérationnels et permet aux entreprises de se développer à l'échelle mondiale en toute confiance.

L'avenir du commerce électronique transfrontalier appartient aux entreprises qui gèrent la complexité avec des outils intelligents. L'intégration de l'expédition n'est plus optionnelle, c'est la base d'une croissance durable.

👉 Découvrez comment simplifier les opérations de commerce électronique à l'échelle mondiale avec Colis postal.

Aperçu de l'industrie

nouvelles via la boîte de réception

Nulla turp dis cursus. Integer liberos euismod pretium faucibua