International Tracking for the Middle East: Typical Delays and How to Avoid Them

International Tracking for the Middle East can feel unpredictable when scan events pause, handoffs change carriers, or customs takes longer than expected. Buyers often read “no updates” as “lost,” so delays quickly become support tickets and refund pressure. The good news is that most Middle East tracking delays follow repeatable patterns. Once you know where they happen and what triggers them, you can prevent many cases and resolve the rest faster.

1) How Middle East tracking differs from other regions

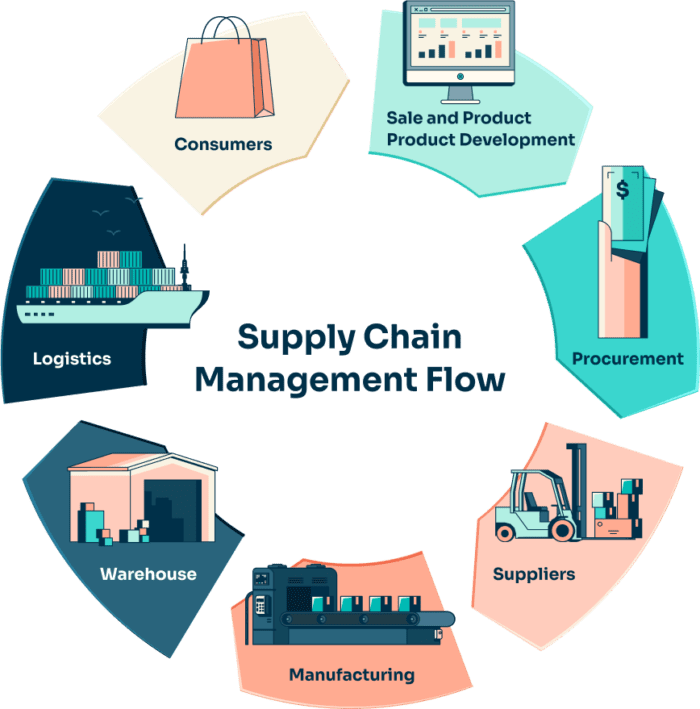

Routes into the Middle East usually involve more handoffs than domestic shipping. That handoff chain matters because every partner has its own scan rules.

1.1 International Tracking for the Middle East relies on multiple carrier handoffs

A typical shipment can move through:

- Origin pickup and export processing

- Airline linehaul (sometimes via a regional hub)

- Import gateway facility

- Customs processing

- Local last-mile carrier

- Delivery attempt and proof of delivery

If the next partner ingests data late, tracking may look “frozen” even when the parcel keeps moving.

1.2 “No update” often means “no scan”

Many lanes do not scan every step. Also, some operators batch-upload events. So you can see a long gap, then several events appear at once. That pattern is common during peaks.

2) Typical delays you will see International Tracking for the Middle East

Most tracking issues fall into five categories. If your team labels them correctly, you can respond with the right playbook instead of generic replies.

2.1 Customs holds from unclear item data

Customs delays often start with preventable data problems, such as:

- Vague descriptions like “gift,” “parts,” or “accessories”

- Missing unit value, currency, or item count

- HS code mismatch (or no HS code in the paperwork)

- Multi-item parcels without an itemized invoice

- Declared weight/value that does not match the parcel

Tracking signs: “Clearance delay,” “Held by customs,” “Awaiting documentation,” or a long gap after “Arrived at destination.”

2.2 Address and phone number failures

In many Middle East markets, the phone number is as important as the street line. Drivers and hubs often confirm delivery by call or SMS.

Common issues:

- Missing country code or wrong digits

- No building/villa number, no district, or no landmark

- Recipient name too short to match ID checks when required

- P.O. Box needed for certain services, but not provided

Tracking signs: “Address issue,” “Consignee not reachable,” “Delivery attempted,” “Held for pickup.”

2.3 Last-mile delivery issues in the Middle East: what causes the slowdown

A parcel can arrive quickly and then wait to enter the local delivery network.

Typical causes:

- Backlog at the destination warehouse intake

- Manifest mismatch (parcel arrived, but the system cannot match EDI)

- Local carrier capacity limits during sales events

Tracking signs: “Arrived at local facility” repeats, but “Out for delivery” does not appear.

2.4 Linehaul capacity and security screening

Some shipments face extra screening, and flight capacity tightens in peak season. When lift is limited, parcels queue.

Triggers include:

- Battery-related items (even when compliant)

- High peak volumes and limited flights

- Reroutes through alternate hubs

Tracking signs: “Processed at facility” repeating, or “Departed” with no arrival scan longer than your normal lane baseline.

2.5 Calendar effects and holiday slowdowns

Business days differ across the region. In some markets, weekends fall on Friday/Saturday. Holiday seasons also change staffing and response time.

Tracking signs: slower customs release, slower last-mile pickup, and longer “at facility” dwell time.

3) How to avoid delays before the parcel ships

Prevention is cheaper than escalation. Most avoidable delays come from missing data and wrong service selection.

3.1 Standardize a Middle East-ready address format

At checkout, guide the buyer to provide:

- Full name (first + last)

- Mobile number with country code

- District/area + street

- Building/villa + apartment/unit

- City + region/province (when applicable)

- Landmark field (optional but very helpful)

Also, add simple validation for phone number length and country code. You will reduce failed delivery attempts immediately.

3.2 Improve customs descriptions and invoices

Use customs-friendly item names that match reality. Replace vague text with clear product terms.

Better examples:

- “Phone case” instead of “accessory”

- “Cotton T-shirt” instead of “clothes”

- “Stainless steel bottle” instead of “bottle”

Invoice basics that reduce holds:

- Itemized lines (quantity, unit price, total)

- Currency and seller details

- Country of origin when your workflow supports it

- Consistent declared weight/value across systems

3.3 Select lanes based on visibility, not only speed

A fast linehaul is not enough if customs and last-mile scans are weak. When choosing a service, prioritize:

- Clear milestone scans (arrival, customs start, customs release, last-mile handoff)

- Strong EDI reliability (events post on time)

- Local recipient contact support (SMS/call)

- A practical exception process (trace tickets, re-delivery scheduling)

This makes tracking more trustworthy, which reduces “where is my parcel” tickets.

4) How to avoid delays after shipping: tracking rules and playbooks

Once the parcel ships, speed matters less than early detection. You want to act before the buyer loses confidence.

4.1 Track by milestones, not just total days

Define “normal” ranges for each milestone on your main lanes:

- Export acceptance appears within 24–48 hours

- Departure appears within your lane’s typical window

- Arrival scan appears within a defined range

- Customs start-to-release has a target SLA

- Last-mile handoff happens soon after clearance

When you measure by milestones, you can isolate the bottleneck fast.

4.2 Set proactive alerts for high-risk events

Simple alerts reduce escalations:

- No update for 48–72 hours after “Arrived at destination”

- Customs status unchanged for X days

- “Delivery attempted” appears more than once

- Any “Address issue” event

- “Held for pickup” without buyer action after 24–48 hours

Then route each alert to the right script, not a generic apology.

4.3 Last-mile delivery: how to prevent delays and reduce tickets in the Middle East

When a buyer asks for help, answer with a decision and a next step.

Examples:

- Address issue: confirm phone/address, push correction to carrier, request a landmark

- Customs hold: send invoice copy, confirm item list/value, request required documents quickly

- Last-mile delay: open a trace ticket, share the next milestone and escalation timing

- Attempted delivery: schedule re-delivery or provide pickup instructions immediately

Specific action builds trust and keeps the buyer waiting for delivery instead of requesting a refund.

5) Status messages that confuse buyers and how to explain them

Clear explanations reduce disputes.

5.1 “Arrived at destination facility”

Meaning: the parcel reached the import gateway or local hub and waits for processing or injection.

What to tell the buyer: “Next expected step is customs processing or last-mile handoff. If there is no update within 48 hours, we escalate.”

5.2 “Customs clearance delay”

Meaning: customs needs verification, documentation, or inspection time.

What to do: request missing details and provide the invoice fast. Delays shrink when you respond quickly.

5.3 “Delivery attempted”

Meaning: the driver could not complete delivery.

What to do: confirm contact details, propose a delivery window, or switch to pickup if it is faster.

Conclusion

International Tracking for the Middle East becomes far more predictable when you manage it as a system: clean address and invoice data, lanes chosen for visibility, milestone-based monitoring, and fast exception playbooks. Most delays come from customs data gaps, contact failures, last-mile injection queues, capacity constraints, and calendar effects. If you tighten your pre-ship data and run proactive alerts after dispatch, you will cut “no update” anxiety, reduce support tickets, and protect revenue from refund and chargeback leakage.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua