Top Customs and Trade Compliance Mistakes

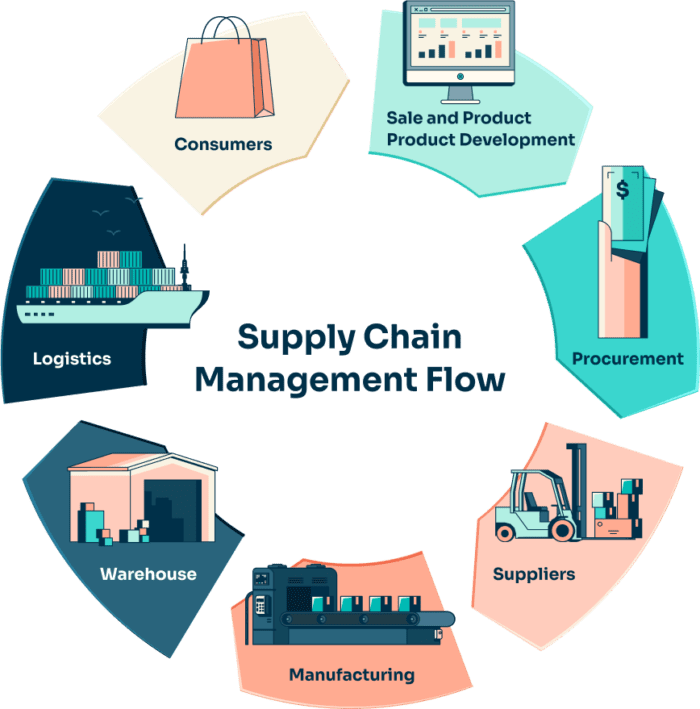

In today’s globalized economy, customs and trade compliance plays a critical role in international business operations. Yet many companies—large and small—struggle to maintain consistent compliance. Mistakes in this area can result in fines, shipment delays, and even the loss of import/export privileges. By identifying the most common errors and implementing preventive measures, businesses can mitigate risks and improve supply chain efficiency.

1. Inaccurate Tariff Classification

One of the most frequent missteps in customs and trade compliance is incorrect Harmonized System (HS) code classification. Each product must be assigned a specific code that determines duty rates and regulatory requirements. Misclassification—whether intentional or accidental—can lead to overpaying duties or, worse, severe penalties for underpayment.

Avoidance Tip: Invest in professional classification tools or services. Regularly train staff and verify codes using official customs databases in each jurisdiction.

2. Underestimating the Importance of Country of Origin

Declaring the wrong country of origin can cause serious compliance issues. This affects not only tariff rates but also eligibility for Free Trade Agreements (FTAs) and labeling regulations. Some companies mistakenly rely on the country of shipment rather than the true origin of manufacturing or substantial transformation.

Avoidance Tip: Maintain clear documentation tracing the origin of each product component. Apply the appropriate rules of origin as defined by the relevant trade agreements or customs authorities.

3. Failure to Screen Restricted Parties

Engaging with individuals, companies, or countries on sanctioned or denied-party lists is a major violation of trade compliance laws. Many organizations fail to screen their customers, suppliers, or logistics partners properly, exposing themselves to legal and reputational damage.

Avoidance Tip: Use automated denied-party screening tools that integrate with customer relationship and procurement systems. Screen all entities before initiating transactions, and update records frequently.

4. Incomplete or Inaccurate Documentation

Incomplete shipping documentation—such as commercial invoices, packing lists, and bills of lading—can delay customs clearance or lead to penalties. Incorrect declared values, missing signatures, or misaligned shipment details are common problems.

Avoidance Tip: Standardize documentation processes. Use digital templates and enforce a double-check policy before shipments leave the warehouse. Periodically audit documentation for consistency.

5. Ignoring Export Control Regulations

Exporting sensitive goods or technologies often requires a license. Companies operating in high-tech, defense, or dual-use sectors sometimes neglect export control rules like the U.S. EAR or ITAR regulations, believing they only apply to large manufacturers.

Avoidance Tip: Conduct a product classification analysis for export control purposes. If any goods fall under restricted categories, obtain necessary licenses and train staff accordingly.

6. Mismanaging Customs Valuation

Incorrect valuation is another major issue in customs and trade compliance. Whether a company undervalues goods to reduce duties or fails to include assists, royalties, or freight charges in declared values, the result can be audits, penalties, or legal action.

Avoidance Tip: Follow the customs valuation rules of each importing country. Include all relevant costs in the declared value and document the methodology used in pricing.

7. Lack of Internal Compliance Policies

Many businesses operate without a formal trade compliance program. This leads to inconsistent practices, limited accountability, and increased exposure to regulatory risks. Without internal controls, even experienced teams can make errors.

Avoidance Tip: Develop a written compliance manual outlining procedures, responsibilities, and escalation paths. Appoint a dedicated compliance officer or establish a compliance team to oversee day-to-day operations.

8. Poor Recordkeeping

Customs authorities often request documentation during audits or investigations. Companies that fail to maintain records for the required period—usually five years or more—may face penalties or loss of preferential treatment under FTAs.

Avoidance Tip: Implement a centralized recordkeeping system, preferably cloud-based, that stores documents securely and enables easy retrieval. Set reminders for archiving and purging in line with jurisdictional requirements.

9. Overreliance on Third Parties

While freight forwarders, customs brokers, and trade consultants offer valuable support, some businesses rely on them too heavily without understanding their own obligations. This can lead to blind spots and unexpected compliance failures.

Avoidance Tip: Treat third parties as partners, not substitutes. Ensure contracts define responsibility clearly, and review their compliance capabilities regularly. Educate internal teams to understand the basics of customs and trade compliance.

10. Failing to Keep Up with Regulatory Changes

Global trade laws are dynamic. Tariff rates, sanctions lists, and documentation requirements evolve frequently. Companies that do not monitor regulatory updates risk non-compliance simply because they’re applying outdated rules.

Avoidance Tip: Subscribe to updates from customs authorities, international trade organizations, or legal services. Attend webinars and maintain relationships with trade compliance experts to stay current.

Conclusion

Mistakes in customs and trade compliance can be costly—but they are also avoidable. By proactively addressing the common pitfalls discussed above, companies can reduce legal risk, improve operational efficiency, and build a more resilient supply chain. Ultimately, a robust compliance strategy is not just a regulatory necessity—it’s a competitive advantage in the global marketplace.

If your business is engaged in cross-border trade, now is the time to audit your compliance practices, invest in training, and implement structured internal controls. Staying compliant is not a one-time task—it’s an ongoing commitment to doing business responsibly and sustainably.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua

[…] Simplified Customs […]