东南亚的跨境履行:机遇与障碍

跨境履行 随着越来越多的卖家瞄准东南亚地区精通数字技术的年轻消费者,东南亚地区的网络零售业正在迅速发展。希望拓展业务的公司不仅要了解潜力,还要了解可能阻碍业务发展的障碍。东南亚因其不断崛起的中产阶级和强劲的电子商务增长而极具吸引力,但同时也面临着物流分散、监管差异和基础设施差距等挑战。

为什么东南亚是跨境履约的主要市场?

不断增长的电子商务需求

东南亚的 电子商务 市场已成为全球增长最快的市场之一。印度尼西亚、越南、泰国和菲律宾等国家持续保持两位数的增长。消费者喜欢网上购物,尤其是在 Shopee、Lazada 和 Tokopedia 等平台上。这为国际卖家创造了庞大的客户群。

日益壮大的中产阶级

该地区不断崛起的中产阶级推动了对国际产品的需求。消费者不仅追求价格合理的商品,还追求更高品质的品牌和当地可能没有的独特商品。跨境履行使卖家能够快速高效地满足这些需求。

数字支付扩展

另一个机遇在于数字钱包和支付解决方案的迅速普及。从 GrabPay 到 GCash,这些服务使跨境交易更加顺畅。卖家现在可以接触到以前只能使用有限的国际支付方式的客户。

企业的关键机遇

1.区域枢纽的战略位置

东南亚位于全球主要贸易路线之间,地理位置优越,是建立区域物流中心的理想之地。例如,新加坡和马来西亚拥有先进的港口和自由贸易区。企业可以在那里整合货物,并在数天内配送到附近的市场。

2.履约即服务供应商的增长

该地区正在出现新的履约服务提供商,提供仓储、海关支持和最后一英里配送服务。这些合作伙伴使企业无需建设昂贵的基础设施即可扩大规模。像 postalparcel 这样的平台可以将卖家与灵活的本地化解决方案联系起来,以适应不同的市场。

3.移动优先的消费者群体

大多数东南亚购物者将智能手机作为主要购物设备。这一趋势为那些针对移动优先市场优化履约工作流程的公司创造了机遇。快速交货更新、集成应用程序的跟踪和响应式支持可显著提高客户忠诚度。

4.地区贸易协定

区域全面经济伙伴关系(RCEP)等协定旨在降低关税,改善亚太地区的贸易流动。与这些协定保持一致的公司可以降低成本,加快跨境交付。

跨境履约的障碍

分散的物流网络

与欧洲或北美不同,东南亚没有完全一体化的物流网络。每个国家都有自己的基础设施水平,这就造成了送货时间和成本的不一致。例如,印尼农村地区的最后一英里送货时间要比新加坡长很多。

复杂的海关和法规

各国的海关程序差异很大。泰国可能需要特定的产品文件,而越南可能有不同的税收结构。这些差异会延误运输,增加合规成本。企业必须投资于强大的监管知识或与经验丰富的合作伙伴合作。

基础设施差距

曼谷和马尼拉等大城市拥有强大的物流支持,但许多农村地区的道路网络不完善,仓储设施有限。这增加了交货时间,并可能减少 客户满意度 在偏远地区。

高额回报成本

跨境退货仍然是最棘手的问题之一。客户希望退货方便,但国际物流可能会使这一过程既昂贵又耗时。如果没有本地化的退货中心,卖家就有可能失去回头客。

支付和货币障碍

虽然数字钱包在不断增长,但支付偏好却千差万别。一些客户喜欢货到付款,而另一些客户则依赖地区性钱包。货币汇率和交易费用为跨境卖家增加了另一层复杂性。

把握机遇,克服障碍

建立强有力的地区合作伙伴关系

与可靠的本地履行合作伙伴合作是克服物流挑战的最有效方法之一。了解清关、"最后一英里 "交付和客户期望的合作伙伴可以帮助公司更快地适应环境。

利用技术平台

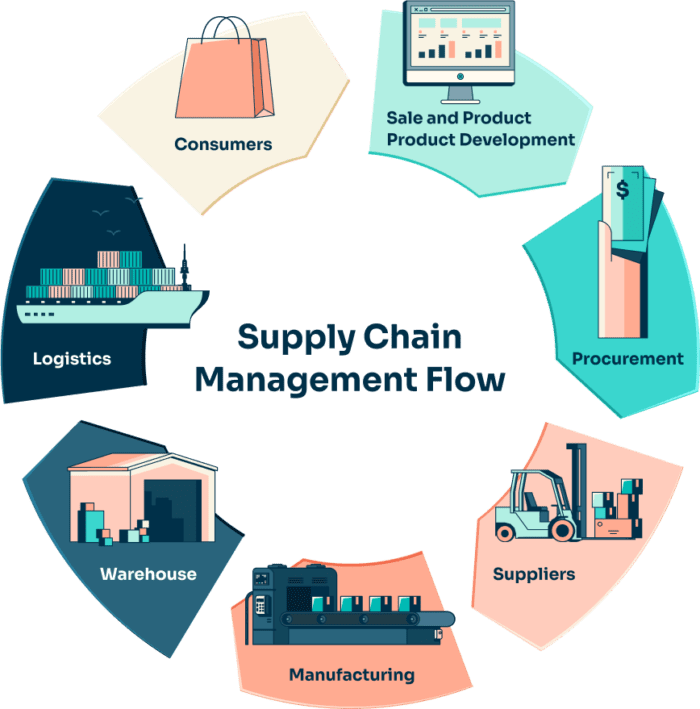

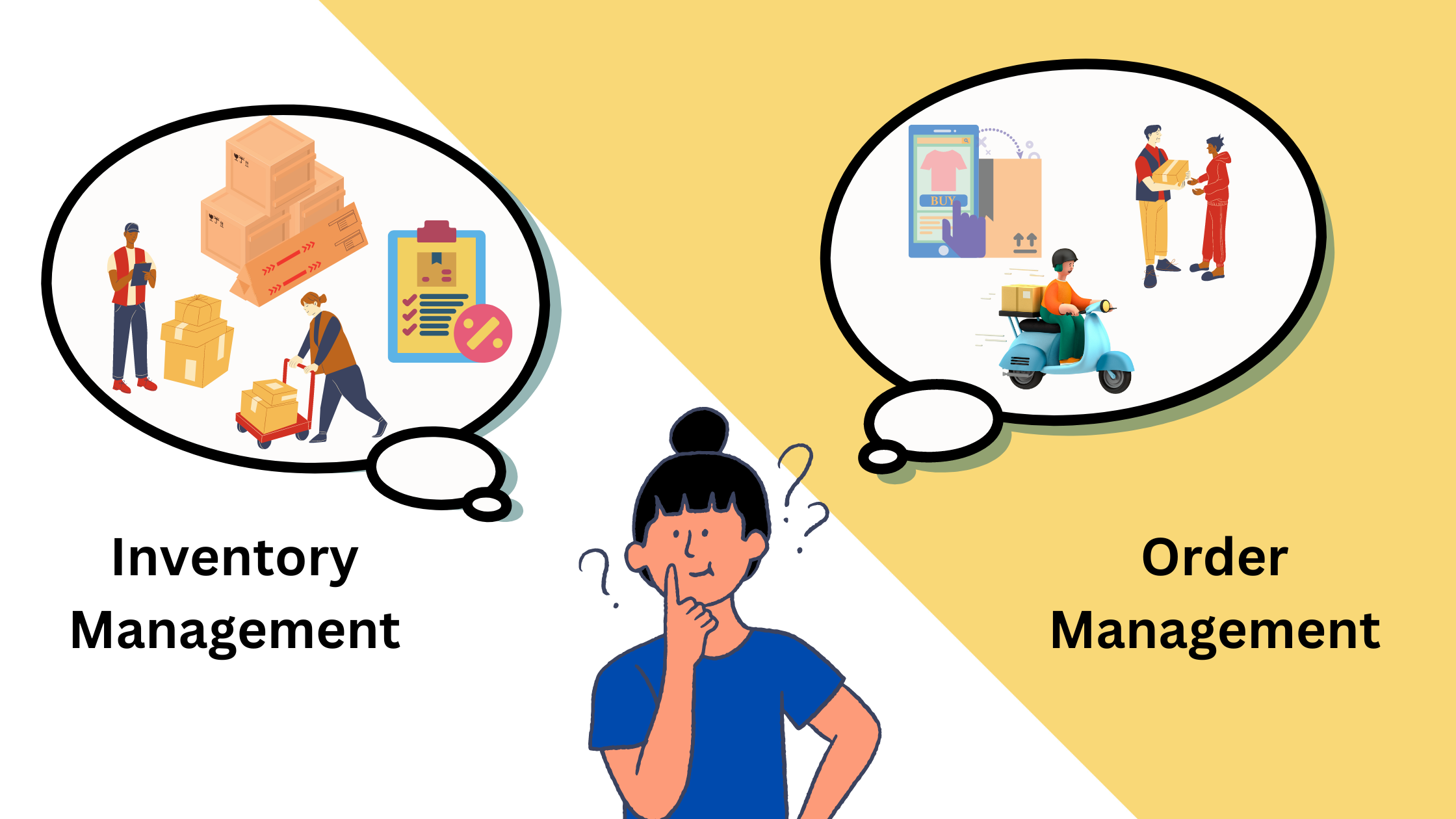

平台,如 邮政包裹 提供跨多个国家的集中库存和订单管理。自动跟踪、实时分析和集成支付解决方案可以减少错误,提高效率。依靠技术的企业可以获得整个供应链的可视性。

平衡速度与成本

快速送货固然重要,但不能以牺牲利润为代价。公司必须在提供快递服务和管理负担得起的标准交付之间取得平衡。使用 "中心辐射 "模式可以起到帮助作用:将货物储存在中心仓库,并根据需要快速运送到附近的市场。

适应当地消费者的偏好

东南亚购物者有着独特的偏好。在越南,货到付款仍占主导地位,而在新加坡,数字支付已成为常态。公司必须根据这些偏好调整履行流程,以保持信任。

更有效地管理回报

为了降低退货成本,公司可以在关键市场建立当地退货点。另一种方法是与 逆向物流 这些供应商专门处理多个国家的退货。这不仅能节省资金,还能建立客户信心。

案例:印度尼西亚与新加坡对比

印度尼西亚:规模和复杂性

印度尼西亚是东南亚最大的市场,人口超过 2.7 亿。但其分布在数千个岛屿上的地理位置使物流工作极具挑战性。爪哇岛以外地区的送货时间可能超过一周。卖家需要多个仓库合作伙伴,而且必须计划更长的交货时间。

新加坡:效率和连通性

另一方面,新加坡是一个小而高效的物流枢纽。其先进的基础设施、优惠的贸易政策和战略性的地理位置,使其成为区域履约的理想基地。许多企业将新加坡作为向印度尼西亚、马来西亚及其他国家发货的主要枢纽。

这种对比说明,企业在保持地区战略的同时,必须以不同的方式适应各个市场。

东南亚跨境履行的未来展望

技术的作用越来越大

人工智能驱动的需求预测、仓库自动化和实时跟踪将继续改变履约方式。采用这些技术的企业将在速度和准确性方面获得竞争优势。

提高客户期望

随着客户越来越习惯于快速可靠的送货服务,他们的期望值也会越来越高。卖家需要在城市地区提供当日或次日送达服务,同时改善农村地区的服务。

将可持续性作为优先事项

环保意识不断提高。消费者和政府向企业施压,要求他们采用环保做法,如使用可回收包装和优化生产流程。 送货 减少排放的路线。

扩大地区合作

各国政府正在努力协调贸易政策和数字基础设施。随着时间的推移,这将减少障碍,改善整个跨境生态系统。随着这些举措的生效,及早准备的企业将从中受益。

结论

跨境履行 在东南亚,机遇与障碍并存。该地区年轻的人口、不断增长的中产阶级和不断扩大的数字经济为其提供了巨大的增长潜力。然而,企业面临着分散的物流、复杂的法规和基础设施缺口。成功的关键在于建立稳固的本地合作伙伴关系,利用 postalparcel 等技术平台,并根据各国的独特需求调整履行战略。在速度、成本和客户体验之间取得适当平衡的卖家,将最有可能在这个充满活力的市场中茁壮成长。

行业洞察

收件箱消息

Nulla turp dis cursus.整体释放,预留空间