Cross-Border Fulfillment and Customs Fees: What You Should Know

In the age of global e-commerce, expanding your business beyond national borders is no longer a luxury—it’s a competitive necessity. However, with international sales come new challenges, especially in cross-border fulfillment and customs fees. For small and medium-sized enterprises (SMEs), navigating these complexities can feel overwhelming. That’s where intelligent logistics solutions like PostalParcel come in.

In this article, we’ll break down what cross-border fulfillment involves, how customs duties and taxes are calculated, and what businesses can do to simplify the process and reduce costs.

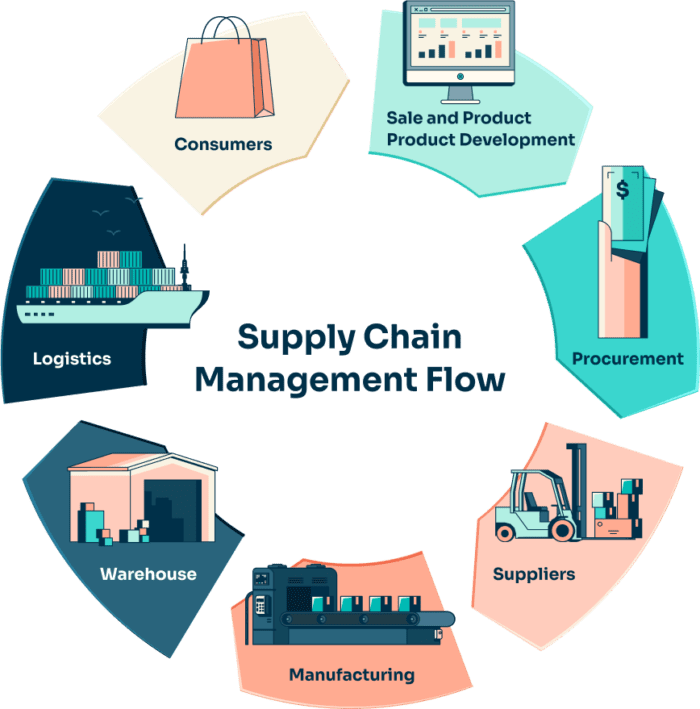

1. What Is Cross-Border Fulfillment?

Cross-border fulfillment refers to the process of storing, packing, and shipping products to international customers from warehouses that may be located outside the customer’s country. This model allows merchants to sell globally without maintaining physical infrastructure in each target market.

There are typically two models:

- Direct Fulfillment: Orders are shipped internationally from the seller’s country.

- Localized Fulfillment: Inventory is pre-stocked in foreign warehouses (e.g., within the EU or North America) for faster local delivery.

At PostalParcel, we offer both models through a flexible fulfillment network that adapts to your growth stage and target regions.

2. Understanding Customs Duties and Taxes

When goods cross borders, they’re subject to customs clearance procedures, which often include duties, value-added taxes (VAT), and other import-related charges. These costs are typically determined based on the following factors:

- Declared value of the shipment

- Product category or HS (Harmonized System) code

- Country of origin and destination

- Shipping method and Incoterms (e.g., DDU vs. DDP)

Common Fee Types:

- Import Duty: A tax the destination country imposes, usually based on a percentage of the product’s value.

- VAT/GST: Value-added tax or goods and services tax applies to countries like the UK, the EU, and Australia.

- Brokerage or clearance fees: Charged by shipping carriers or customs brokers for handling the import process.

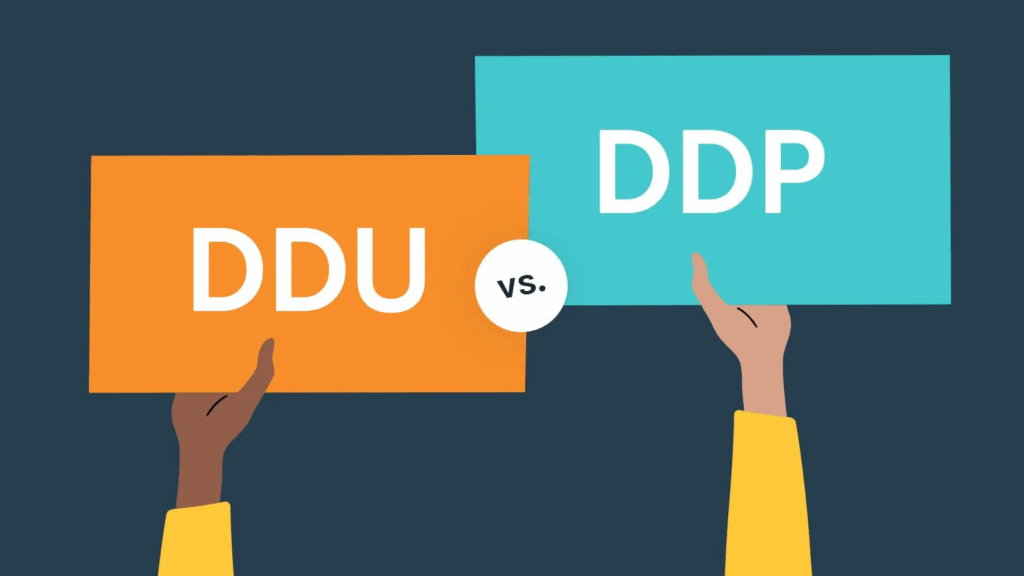

3. DDU vs. DDP: Who Pays the Customs Fees?

One of the most critical aspects of cross-border fulfillment is determining who pays the customs fees—you or your customer.

- DDU (Delivered Duty Unpaid): The customer pays duties upon arrival. While this reduces upfront seller costs, it often leads to poor customer experience and high return rates.

- DDP (Delivered Duty Paid): The seller pays duties in advance, ensuring smooth delivery with no unexpected charges for the customer. This improves trust and satisfaction.

PostalParcel helps merchants set up DDP shipping options with pre-calculated customs fees, reducing delays and customer complaints.

4. How PostalParcel Simplifies Cross-Border Fulfillment

At PostalParcel, we understand the pain points of international shipping and customs complexity. That’s why we offer an end-to-end solution to simplify every step of cross-border logistics:

Multi-Warehouse Fulfillment

Strategically located warehouses near key markets help reduce delivery time and avoid repeated customs clearance for every parcel.

Smart Carrier Routing

We automatically select the best shipping option for each destination based on cost, speed, and customs efficiency.

Customs Documentation Automation

Our system generates commercial invoices, HS codes, and export/import documentation in compliance with the destination country’s requirements.

Transparent Duty Estimation

We provide real-time tax and duty calculation tools so you and your customers know exactly what to expect before checkout.

5. Tips to Reduce Customs-Related Delays and Costs

While platforms like PostalParcel handle much of the heavy lifting, there are still proactive steps merchants can take to minimize customs issues:

- Use accurate HS codes to ensure correct tax classification

- Declare the correct value of the goods to avoid penalties

- Provide clear product descriptions to prevent customs holds

- Include customer contact information to facilitate clearance

- Stock fast-moving items locally in target markets to bypass repeat import processes

Following these best practices can reduce customs-related delays and maintain high delivery success rates.

6. The Cost of Getting It Wrong

Failing to properly manage customs can lead to:

- Delivery delays and failed shipments

- Frustrated customers and negative reviews

- Return-to-sender fees

- Unexpected cost overruns that hurt profit margins

- In some cases, legal penalties for undervaluation or incorrect documentation

For growing brands, these issues can quickly escalate into lost revenue and damaged reputation. With PostalParcel, you can access automation tools and expert support to avoid these pitfalls.

Conclusion

Cross-border fulfillment and customs fees don’t have to be a headache. With the right logistics platform, small businesses can confidently sell internationally, providing fast, transparent, and compliant shipping experiences to customers around the globe.

At PostalParcel, we empower your brand with localized fulfillment, automated customs handling, and multi-carrier shipping—all under one intelligent platform. Whether you’re just starting or scaling into new markets, we’re here to make cross-border logistics simple, cost-effective, and growth-driven.

Ready to go global without the hassle? Let PostalParcel handle the complexity so you can focus on growing your business.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua