AML and Trade Compliance: Key Measures for Secure Trade

Anti-money laundering (AML) and trade compliance are two critical components for businesses involved in global trade. Both are designed to ensure legal and ethical business practices, protect against illegal activities, and maintain the integrity of the global financial system. In this article, we’ll explore the relationship between AML and trade compliance, their importance, and the steps businesses can take to maintain regulatory compliance.

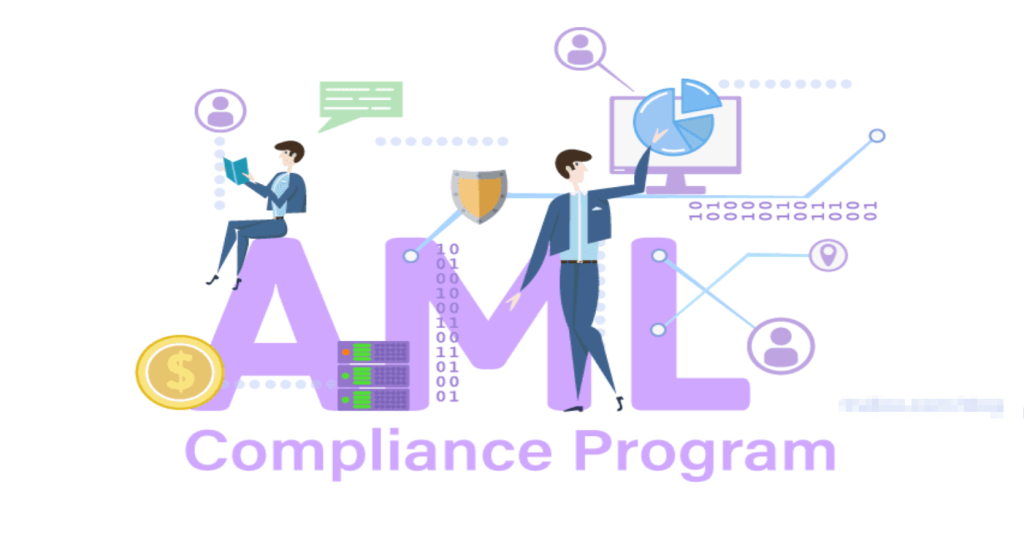

What is Anti-Money Laundering (AML)?

Anti-money laundering (AML) refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. The aim is to combat money laundering and the financing of terrorism. AML regulations are globally enforced and require businesses, especially those in the financial sector, to detect and report suspicious activity that could involve money laundering or terrorist financing.

Money laundering typically involves multiple steps, including:

- Placement: Introducing illicit money into the financial system.

- Layering: Obscuring the origins of the money through complex transactions.

- Integration: Making the money appear legitimate by integrating it into the economy.

AML policies help companies identify these suspicious activities, ensure transparency, and prevent financial systems from being exploited for criminal purposes.

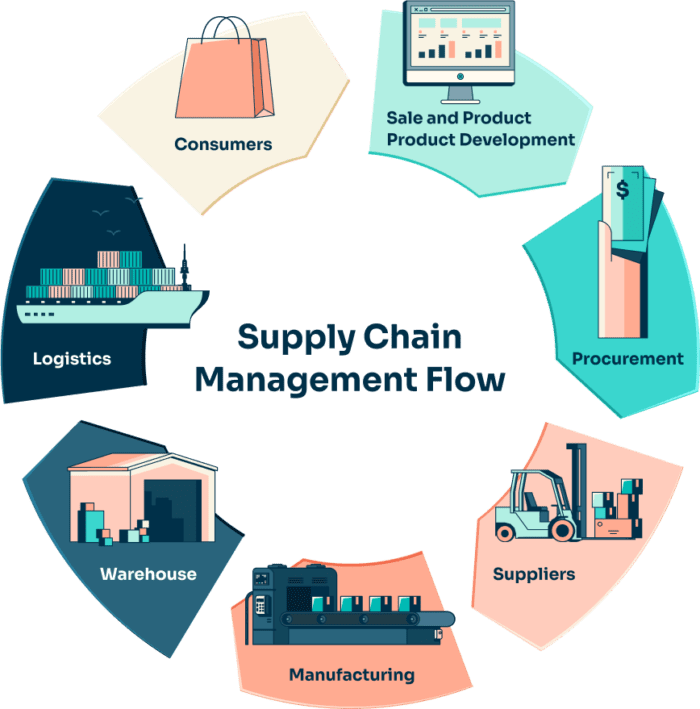

What is Trade Compliance?

Trade compliance refers to the adherence to laws and regulations that govern the movement of goods and services across borders. These regulations are designed to protect national security, promote fair trade, and prevent illegal transactions. It includes:

- Export controls: Restrictions on the export of certain goods and technologies, often for national security reasons.

- Sanctions and embargoes: Restrictions on doing business with specific countries, entities, or individuals.

- Customs regulations: Ensuring goods are properly declared and taxed at borders.

Trade compliance ensures that businesses do not engage in trade with sanctioned countries, entities involved in illegal activities, or businesses that pose a national security threat.

The Connection Between AML and Trade Compliance

They are intertwined. Both aim to prevent illicit activities, but they focus on different aspects of business operations. In international trade, businesses may inadvertently become involved in illegal activities such as:

- Facilitating the flow of money from illegal trade

- Supporting organizations or individuals on sanctions lists

- Engaging in trade that involves illegal goods, such as arms or drugs

By implementing robust trade compliance practices, businesses can also enhance their AML efforts. Similarly, ensuring effective AML procedures can help prevent engaging in illegal trade activities.

Key AML and Trade Compliance Measures

To ensure compliance with both AML and trade regulations, businesses should implement several key measures:

1. Know Your Customer (KYC) Procedures

KYC procedures are crucial for AML compliance. Companies must verify the identity of their customers, partners, and suppliers before entering into business transactions. This helps to ensure that they are not dealing with individuals or entities involved in illegal activities.

In the context of trade compliance, KYC ensures that businesses are not unknowingly facilitating trade with sanctioned entities or criminals. This process involves:

- Collecting information about the customer’s identity, business activities, and ownership structure.

- Checking the customer’s background against international sanction lists and databases.

2. Transaction Monitoring

Monitoring the flow of goods and money is essential for identifying suspicious activities in international trade. Companies must track transactions, especially those involving high-risk countries or large sums of money. This helps identify irregularities such as:

- Unusual payment methods or routes

- Transactions that don’t align with the nature of the business

- Discrepancies in the trade documentation

By implementing strong transaction monitoring systems, businesses can catch potential red flags early and take corrective action.

3. Sanctions Screening

Sanctions screening is another essential measure for both of them. Companies must check their business partners against official sanction lists, such as those maintained by the United Nations, European Union, and U.S. Department of the Treasury.

This process helps ensure that businesses do not engage in transactions with sanctioned countries or individuals involved in criminal activities, terrorism, or other illicit operations. It also ensures compliance with national and international laws.

4. Export Control Compliance

Certain goods, services, or technologies are subject to export controls, meaning they cannot be sold or transferred to specific countries, entities, or individuals. Trade compliance efforts must ensure that businesses do not inadvertently export controlled items to embargoed or high-risk destinations. This involves:

- Checking that products are not on prohibited export lists

- Ensuring that the products are not used for illegal purposes, such as weapons development or terrorism financing

Export control compliance is critical for ensuring that businesses do not violate trade restrictions and inadvertently support illegal activities.

5. Reporting Suspicious Activity

Under both AML and trade compliance regulations, businesses are required to report suspicious activity to the relevant authorities. This may involve:

- Reporting unusual transactions to financial regulators

- Reporting trade activities that violate sanctions or export control regulations

- Notifying authorities about discrepancies or potential fraud in trade documentation

Prompt and accurate reporting is essential for preventing further illegal activity and protecting the business from potential legal and financial penalties.

The Role of Technology in AML and Trade Compliance

With the complexity and volume of international trade, companies increasingly rely on technology to manage their AML and trade compliance processes. There are various software tools available that help businesses:

- Automate KYC checks and customer screening

- Monitor and analyze transaction data

- Screen for sanctions violations and export control breaches

- Generate reports for regulatory compliance

Using technology allows businesses to streamline their compliance efforts, reduce human error, and stay up-to-date with ever-changing global regulations.

Consequences of Non-Compliance

Failure to comply with AML and trade regulations can result in significant consequences, including:

- Fines and Penalties: Governments impose hefty fines on businesses that violate AML and trade compliance laws.

- Reputational Damage: Non-compliance can severely damage a company’s reputation, making it harder to secure business relationships in the future.

- Criminal Charges: In some cases, non-compliance can lead to criminal charges, particularly if a company is found to have intentionally facilitated illegal activities.

To avoid these risks, it is crucial for businesses to implement comprehensive compliance programs, continuously monitor transactions, and stay informed about relevant regulations.

Conclusion

Both anti-money laundering (AML) and trade compliance are critical to ensuring that businesses engage in ethical, legal, and secure international trade practices. By adopting robust measures such as KYC, transaction monitoring, sanctions screening, and export control compliance, businesses can prevent illegal activities like money laundering and terrorist financing. In today’s globalized economy, understanding the connection between them and using technology to support these efforts is essential for maintaining a lawful and trustworthy business operation.

Industry Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua